[ad_1]

This consists of creating an extra pool of working capital to purchase uncooked supplies upfront that are imported by way of that route, air freight to satisfy pressing demand and negotiation with shoppers, logistics and insurance coverage firms, business executives mentioned.

Varun Drinks chairman Ravi Jaipuria informed buyers lately the corporate is overstocking the uncooked supplies imported for security causes which is “creating some price.” He mentioned freight charges have turn into dearer all over the place, price of supplies has gone up and a few of the shipments are getting delayed. It has elevated the corporate’s working capital year-on-year.

“So, that’s the reason we’re making it very secure for ourselves and never worrying about further stock price…Some danger safety we’re doing with the geopolitical state of affairs. Instantly the Suez Canal has acquired blocked and we don’t wish to take any possibilities for any items, safeguarding ourselves,” mentioned Jaipuria.

Corporations coping with confectionery mentioned cocoa costs have shot up the roof and they’re making an attempt to obtain upfront in bulk. Executives mentioned the worldwide cocoa scarcity has been exemplified with the Purple Sea disaster.

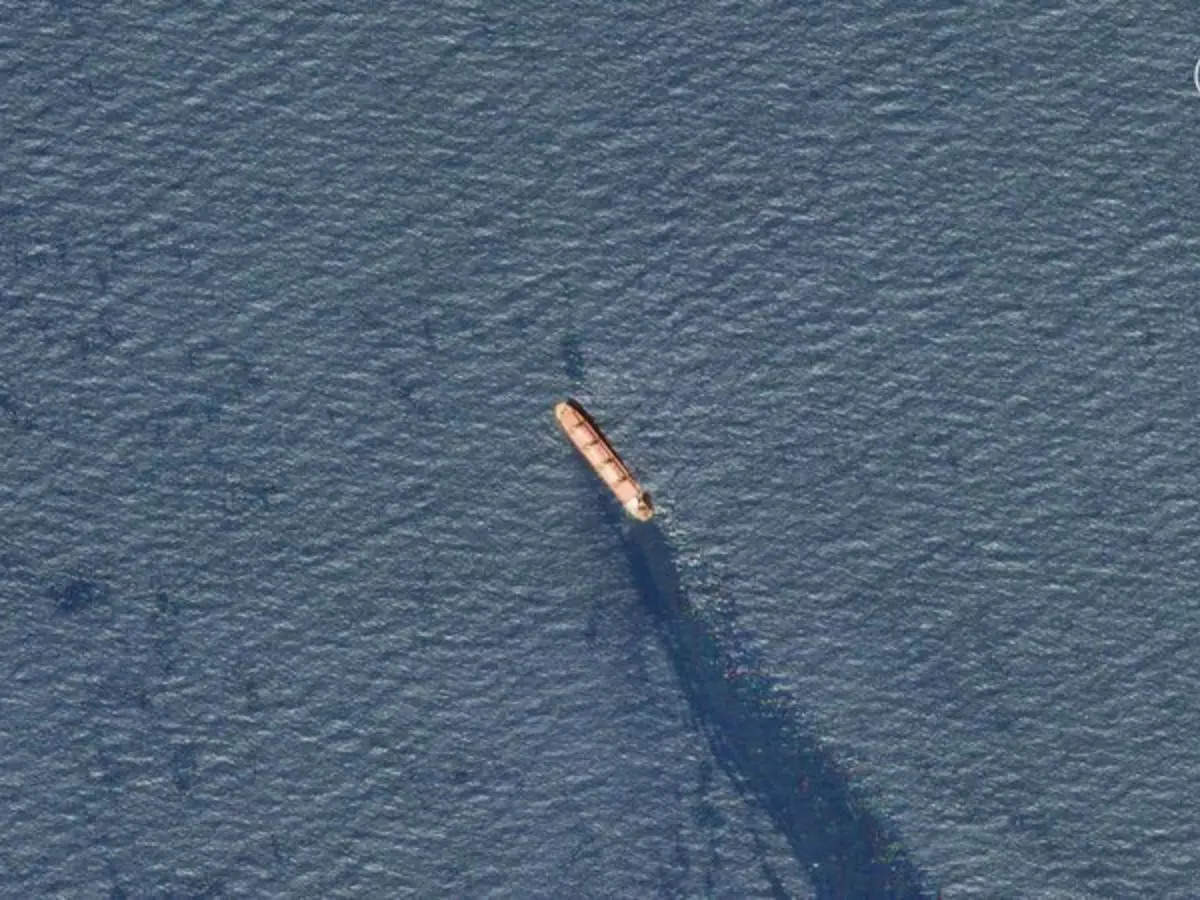

“Even after we are keen to pay a 25-30% premium value, there is no such thing as a straightforward availability of cocoa. This value enhance will influence profitability,” mentioned Parle Merchandise senior class head B Krishna Rao.The Purple Sea disaster entered its fourth month impacting international commerce since this channel is without doubt one of the world’s busiest cargo routes whereby carriers have been compelled to reroute shipments by way of the Cape of Good Hope.Arvind Ltd informed analysts that round Rs 20-25 crore of income has spilled over into the present quarter from the December one because of the disaster because it couldn’t fulfill all orders on account of container logjam. The corporate is negotiating the freight prices for the products the place it has to bear the freight, however for many orders freight is on the account of the shopper, vice chairman Punit Lalbhai mentioned within the latest earnings name.

Gokaldas Exports administration informed analysts earlier this month that a lot of the consumer manufacturers are offsetting incremental insurance coverage by speaking to their logistics accomplice and a few are additionally air freighting to avoid wasting time.

Automotive makers, who export vehicles or import elements by way of this route, mentioned there was some disruption of their operations. MG Motor India chairman emeritus Rajeev Chaba mentioned some elements come from Europe. “If the disaster continues for lengthy, there can be an influence for certain. Already logistics prices have elevated and there’s a delay in shipments,” he mentioned.

Maruti Suzuki govt director (company affairs) Rahul Bharti mentioned because the firm’s exports are diversified throughout a couple of hundred nations of the world, the Purple Sea route impacts a small a part of the whole exports. “And for that half, we now have began delivery our automobiles by way of an alternate route which can result in slight enhance in price and time,” he mentioned.