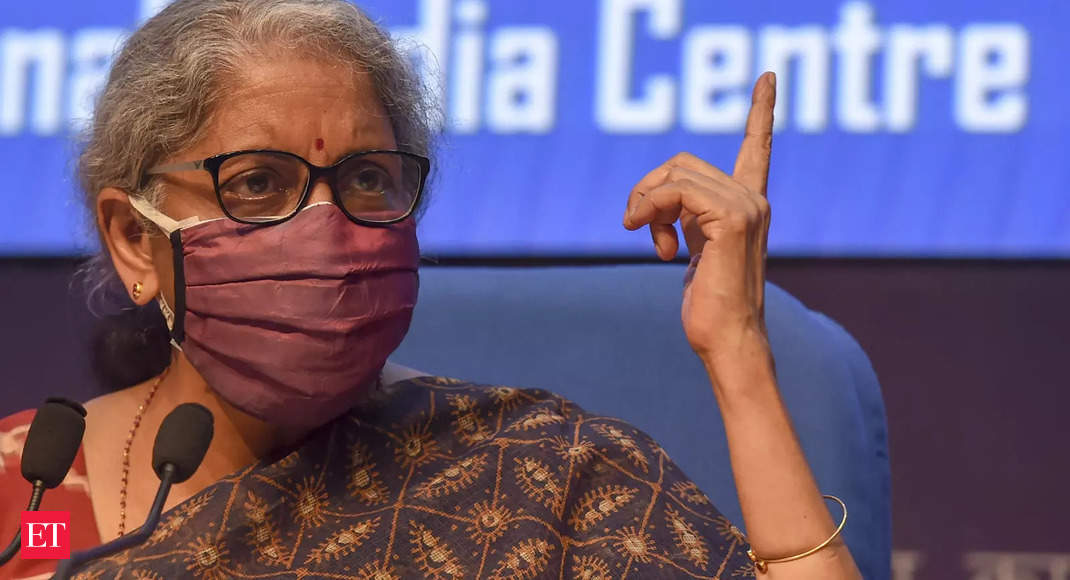

“We have now taken a acutely aware place to not fund restoration by further taxes… We had not carried out final 12 months… we now have not carried out this 12 months,” Sitharaman mentioned, replying to the dialogue on the Finance Invoice within the Lok Sabha on Friday. The decrease home later handed the invoice, giving impact to taxation proposals and finishing the budgetary train for FY23. The decrease home of parliament accepted the 39 official amendments moved by Sitharaman by voice vote.

The price range for FY23 introduced on February 1 raised capital expenditure by 35.4 % to ₹7.5 lakh crore to help the pandemic-hit financial system and encourage non-public funding. The invoice will now be taken up by the Rajya Sabha and are available into impact quickly after receiving presidential assent.

Sitharaman cited an OECD report back to say that as many as 32 nations, together with even developed nations, had raised taxes in the course of the pandemic.

She mentioned the Centre believed in decreasing taxes and that the discount in company tax had helped the financial system, authorities and corporations. “We’re seeing the progress,” she mentioned, including that Rs 7.3 lakh crore had been collected as company tax up to now within the present fiscal 12 months.

The variety of taxpayers has elevated to 91 million from 50 million just a few years again and the federal government is taking steps to widen the tax base, she mentioned.

Tax deduction at supply was one of many authentic methods during which the federal government was monitoring transactions and widening the tax base, the minister mentioned.

On issues expressed by members on the imposition of customs responsibility on umbrellas, she mentioned it was carried out to encourage home manufacturing by MSMEs.

Crypto Tax

Within the price range, Sitharaman had proposed a 30% tax on beneficial properties produced from the switch of any non-public digital digital property from April 1 and 1% tax deduction at supply (TDS) on funds over Rs 10,000 a 12 months and taxation of such presents within the fingers of the recipient.

She rejected criticism that the federal government’s messaging on digital digital property was unclear.

“There isn’t any complicated sign. We’re very clear that there are consultations happening as as to if we need to regulate it to some extent or… completely ban it,” she mentioned. Till then the federal government will levy tax on transactions involving such property.

“Persons are placing cash, individuals are taking cash, individuals are creating property and that property are being bought and purchased. So, clearly, the federal government made its place clear, saying we will tax, the cash being generated out of it,” she mentioned. The minister moved official amendments to tighten the crypto tax regime.

Some opposition members advised laws on digital currencies as a substitute of an outright ban.

Items and Companies Tax

On GST-related amendments launched within the Finance Invoice, FM mentioned these weren’t framed by the Centre and had been moved following suggestions by the GST Council. She mentioned a gaggle of ministers headed by the chief minister of Karnataka was analyzing fee rationalisation.

“We have now a GoM… that’s wanting into it, in order that we will get again to being income impartial, rationalise slabs,” she mentioned.

On the difficulty of arrests underneath GST raised by members, Sitharaman mentioned the supply for imprisonment was just for fraudulent claims of enter tax credit score, deliberate tampering of monetary information, and false info with the intent to evade cost of taxes.

“Imprisonment is barely in case of great nature and never for minor errors or incorrect entries,” she mentioned.

Cess, Surcharge

The minister clarified that retrospective modification on cess and surcharge had been launched for extra readability. The Finance Invoice has proposed an modification to the revenue tax legislation, offering that cess and surcharge can’t be claimed as deduction. There could be no penalty if the deduction taken earlier was disclosed and acceptable tax and curiosity paid.

“Now we assess you so you may pay up what’s authentic tax. There isn’t any penalty should you come by yourself and except we take it again to the time when misuse has began,” she mentioned.