The SDF fee has been set at 3.75%, increased than the three.35% fastened reverse repo fee, which is the speed at which banks park their extra funds with the RBI in alternate of presidency securities as collateral. With a better fee supplied on SDF, massive banks which have extra securities is not going to thoughts parking their further deposits at a better fee with none collateral.

Businesses

BusinessesThe repo fee, which is the primary lending fee of the RBI at the moment at 4% is simply 25 foundation factors increased than the SDF fee with the marginal standing facility (MSF) fee, at which banks borrow emergency funds by paying increased than the repo fee, is at 4.25%. One foundation factors is 0.01 share level.

“The SDF will exchange the fastened fee reverse repo (FRRR) as the ground of the LAF hall…With the introduction of the SDF at 3.75%, the coverage repo fee being at 4% and the MSF fee at 4.25%, the width of the LAF hall is restored to its pre-pandemic configuration of fifty foundation factors. Thus, the LAF hall will likely be symmetric across the coverage repo fee with the MSF fee because the ceiling and the SDF fee as the ground with rapid impact,” RBI stated.

Bankers stated the SDF will assist RBI to suck out extra liquidity with out providing any securities but additionally strikes in a single day charges increased with out truly mountaineering charges. “For RBI it makes it simpler to suck out liquidity with out the operational problems with providing securities as a result of the systemic liquidity is simply too massive for it to normalise in a number of months. It has incentivised banks by providing increased charges. RBI doesn’t need rates of interest to go up sharply however at identical time can’t preserve charges the place they’re so that is a technique of doing it,” stated Sastry Venkataramana, deputy managing director, State Financial institution of India (SBI).

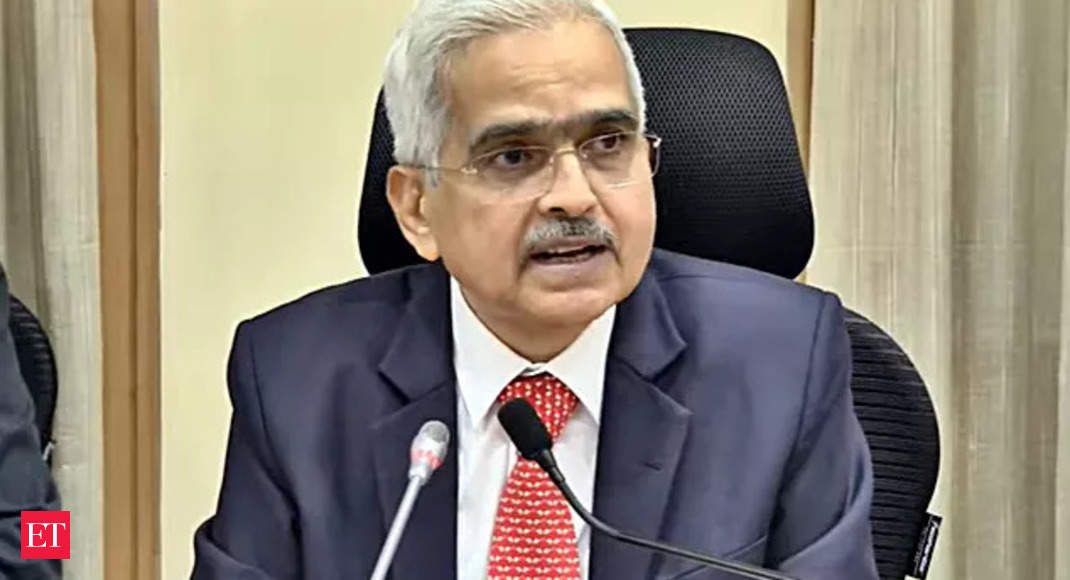

Bond yields jumped following the announcement, particularly as governor Shaktikanta Das stated the central financial institution’s focus has moved in the direction of controlling inflation moderately than nurturing development. The yield on the benchmark ten-year bond rose 16 foundation factors to finish at 7.07% on Friday.

“Charges are anticipated to rise, significantly on the shorter finish of the curve. Maybe the impression would have been higher if they’d saved the SDF window open to all banks, even the small ones which want collateral. However the course is clearly for charges to maneuver increased,” stated Naveen Singh, head fastened earnings at ICICI Securities Main Dealership.