[ad_1]

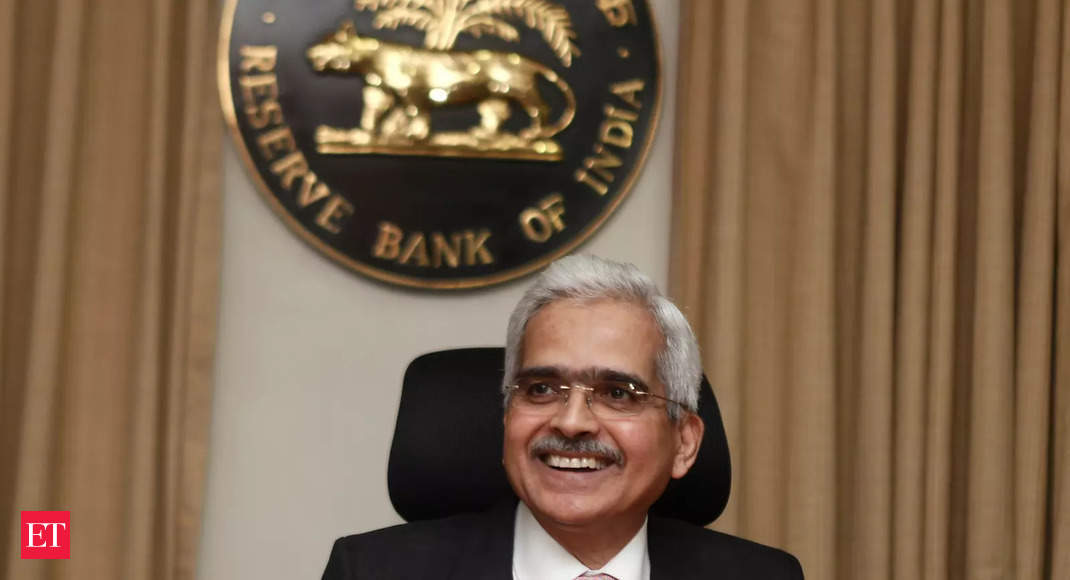

Conferences of the Financial Coverage Committee, presided over by Governor of the RBI Shaktikanta Das, are set for September 28–30. The choice will probably be made public on Friday (September 30).

After mountain climbing the short-term lending charge by 40 foundation factors in an off-cycle transfer in Might, the RBI elevated the repo charge by 50 foundation factors in every of the months of June and August based mostly on the suggestions of the MPC.

The buyer worth index (CPI), which relies on retail inflation and had begun to reasonable in Might, has as soon as extra firmed as much as 7% in August. When drafting its bimonthly financial coverage, the RBI considers retail inflation.

The US Fed hiked rates of interest for the third time in a row, rising them by 75 foundation factors to convey the goal vary to three–3.25%. To manage inflation, the central banks of the UK and the EU have additionally raised rates of interest.

In a report, Financial institution of Baroda mentioned the financial coverage this time will probably be extra intently watched, given the latest developments within the foreign exchange market following the Fed elevating charges final week. The RBI’s view on all points will present steering to the market on repo charge, stance, progress and inflation projections, rupee, liquidity and world view.

“Within the upcoming credit score coverage of RBI, which is scheduled on 30 September 2022, we anticipate MPC to lift the repo charge by one other 50 bps. We anticipate charges to extend up until 6-6.25 per cent,” the report acknowledged.

The RBI has been given a mandate by the federal government to take care of retail inflation at 4% with a 2% tolerance on either side.

In an effort to regulate inflation, the central financial institution has hiked the rate of interest by a complete of 140 foundation factors since Might. The RBI has maintained its CPI inflation projection for the present fiscal 12 months at 6.7% regardless of this important improve, anticipating inflation to remain past its consolation stage.

Based on V Swaminathan, govt chairman of Andromeda Loans, the RBI is pressured to lift charges because of the rise in rates of interest in different economies.

“Nonetheless, inflation in India isn’t as a lot of an issue and the quantum of improve needs to be moderated on this gentle. Residence mortgage debtors could be properly suggested to discover fixed-rate loans in this sort of atmosphere,” Swaminathan mentioned.

Anuj Puri, chairman of the Anarock Group, an actual property consulting agency, famous that many countries have not too long ago skilled back-to-back will increase in rates of interest because of the world inflationary pressures.

Resulting from its tight ties to the worldwide economic system, India must undertake corrective measures to cut back inflation, which is influenced by each home and worldwide forces.

“A level of discomfort however, a 50-bps hike shouldn’t severely hamper homebuyers’ sentiments. Furthermore, the festive season is across the nook. It is a interval when builders often roll out varied freebies and provides, and we might even see mounted rate of interest assure plans introduced this 12 months,” Puri mentioned.

The rupee appreciated 37 paise to 81.30 towards the US greenback in early commerce on Tuesday because the American foreign money retreated from its elevated ranges.

Tuesday’s closing costs of the fairness benchmarks Sensex and Nifty had been barely decrease as a result of declines in equities within the metallic, banking, and monetary industries.

Inputs from PTI