[ad_1]

Dig Deeper with ITA’s Knowledge Instruments

Anne Flatness, Eak Gautam, Amanda Reynolds and Ian Saccomanno are Worldwide Economists within the Workplace of Commerce and Financial Evaluation

Nonetheless dominated by the COVID-19 pandemic, 2021 was a difficult however hopeful 12 months for U.S. commerce. The publication this week of final 12 months’s commerce knowledge is an efficient alternative to replicate on the exceptional resilience of U.S. exporters.

General, exports of products and providers in 2021 recovered to pre-pandemic ranges, whereas imports exceeded theirs. Due to knowledge from the Division of Commerce’s Bureau of Financial Evaluation and U.S. Census Bureau, ITA can paint a bigger story of how and the place U.S. worldwide commerce recovered, and analyze what obstacles stay.

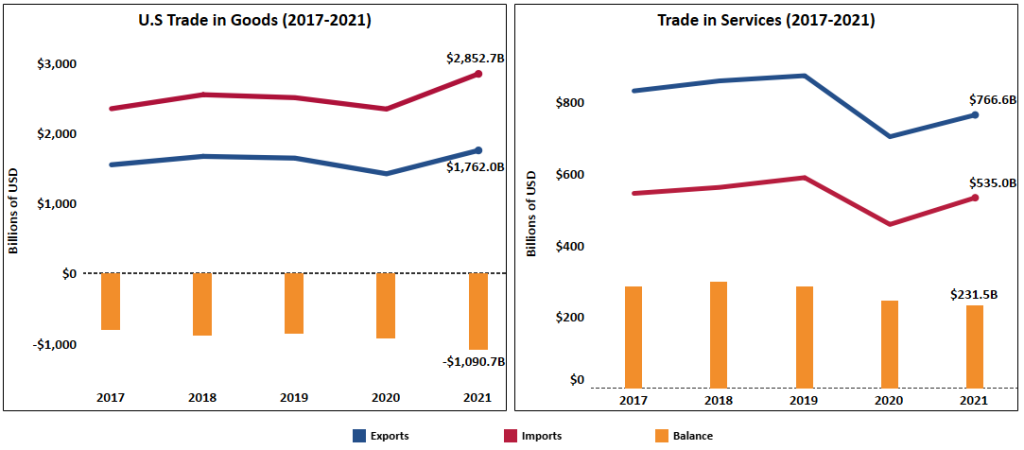

U.S. Commerce in Items and Companies

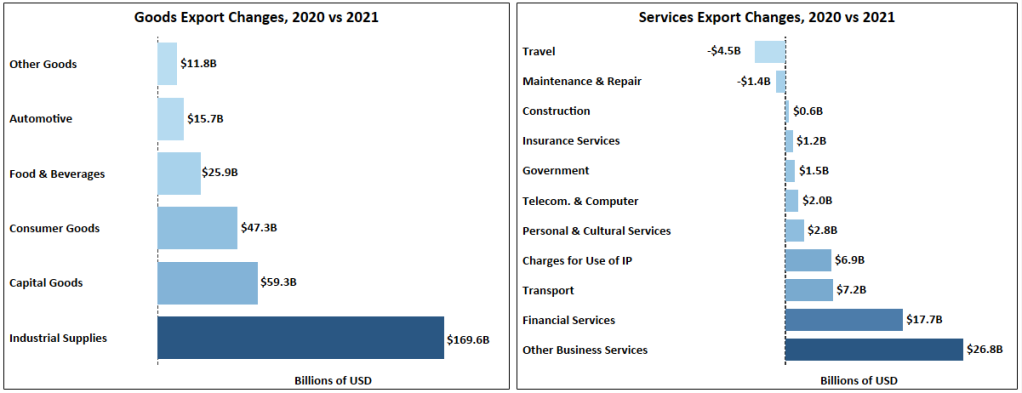

Trying first at ITA’s annual commerce infographic, we will see a divergence between items and providers commerce. Items commerce contains bodily merchandise equivalent to family merchandise, vehicles, and meals, whereas providers commerce contains financial actions equivalent to monetary providers or transportation. Items commerce was sturdy throughout the board; exports and imports each reached new annual data, and all main export sectors have been up from 2020. Whereas providers commerce additionally elevated, exports and imports of providers continued to lag behind 2019 ranges because of worldwide journey. In response to ITA’s Nationwide Journey and Tourism Workplace, each visitation to america and U.S. journey overseas elevated from 2020 to 2021; nevertheless, journey has but to return to pre-pandemic ranges.

Deeper Dive: U.S. Items Commerce by Product

Amidst provide and demand shake-ups from COVID-19, in addition to different shocks just like the Texas winter storms and Hurricane Ida, commerce disruptions have been widespread in 2021. These disruptions had important, at occasions divergent, impacts on main U.S. commerce sectors. For instance, wanting throughout broad industries, we see that Transportation Tools, which was the highest export class for greater than a decade, was displaced by Chemical compounds and Pc and Digital Merchandise in 2021.

An examination of the sub-industry element in TradeStats Categorical reveals causes for this shakeup. Transportation Tools exports have been hampered by the continued weak point of the Aerospace {industry}, largely in civilian airplanes. The contrasting improve in Chemical compounds is principally the results of rising Pharmaceutical and Drugs exports associated to the pandemic, whereas the rise in Computer systems displays elevated Semiconductor exports, that are in excessive demand globally. Oil and Gasoline exports have been additionally up sharply, pushed by rising power costs in 2021.

Imports present an analogous shakeup. On the broad {industry} degree, Pc & Digital Merchandise, which displaced Transportation Tools as the highest sector in 2020, retained that place in 2021 because of continued excessive demand for electronics as folks labored and stayed at dwelling. Main Metals, which broke into the highest 5 in 2020 as gold imports spiked, was displaced by Miscellaneous Manufactures in 2021 after gold demand moderated. Miscellaneous Manufactures contains Medical Tools & Provides equivalent to Surgical Medical Devices and Surgical Home equipment & Provides.

U.S. Items Commerce by Associate

U.S. items commerce with many companions recovered in 2021, assembly or exceeding pre-pandemic ranges. On the export aspect, the U.S. set new data with 57 companions, together with Mexico, China, South Korea and Germany. The highest 4 U.S. items export locations remained unchanged in 2021, and all exceeded their 2019 export ranges. Canada and Mexico continued to be the most important markets for america, adopted by China and Japan.

Under these high 4 companions, nevertheless, relative rankings amongst U.S. companions diversified. In 2021, South Korea handed the UK and Germany to change into america’ fifth largest items export market. Elevated exports of Oil and Gasoline and Mechanical Equipment have been the principle causes for this improve. In distinction, a lagging restoration in exports of Transportation Tools hampered commerce with the UK and Germany.

On the import aspect, whereas the highest 5 companions didn’t change, there was important motion outdoors the highest 5. Vietnam had exceptionally sturdy development in recent times; between 2018 and 2021 its rating amongst U.S. import companions rose from twelfth to sixth. Along with Vietnam, Taiwan and Malaysia have elevated in relative import rating. In all instances, commerce with these companions has elevated in sectors the place we’ve seen declining commerce from China, equivalent to Pc and Digital Merchandise, Attire, and Furnishings. That is indicative of a broader development of commerce diversification away from China since 2018, the place corporations have reported that issues together with commerce insurance policies and the rising price of labor have inspired motion to new international locations.

New Software to Discover Annual and YTD Commerce Knowledge

You don’t must be an economist to discover knowledge your self. Try ITA’s lately modernized TradeStats Categorical (TSE), an interactive knowledge visualization device that {industry} researchers, coverage analysts, and others can use to trace traits in worldwide commerce on the nationwide, state, product, and accomplice ranges. Additionally, take a look at our Commerce Knowledge and Evaluation instruments web page to study our different commerce knowledge analysis platforms. And don’t overlook to bookmark our month-to-month commerce evaluation web page for the latest knowledge releases!