[ad_1]

From August, Bloomberg Information has modified three of the eight indicators it makes use of to trace the economic system’s so-called animal spirits. It now consists of energy demand, items and providers tax assortment, and unemployment charge, instead of the Citi India Monetary Circumstances Index, manufacturing unit and infrastructure output.

The symptoms confirmed sentiment within the providers sector — which accounts for over 50% of the $3.2 trillion economic system — was upbeat, tax income have been strong and demand for loans excessive. A rising jobless charge was the principle drag in the course of the month.

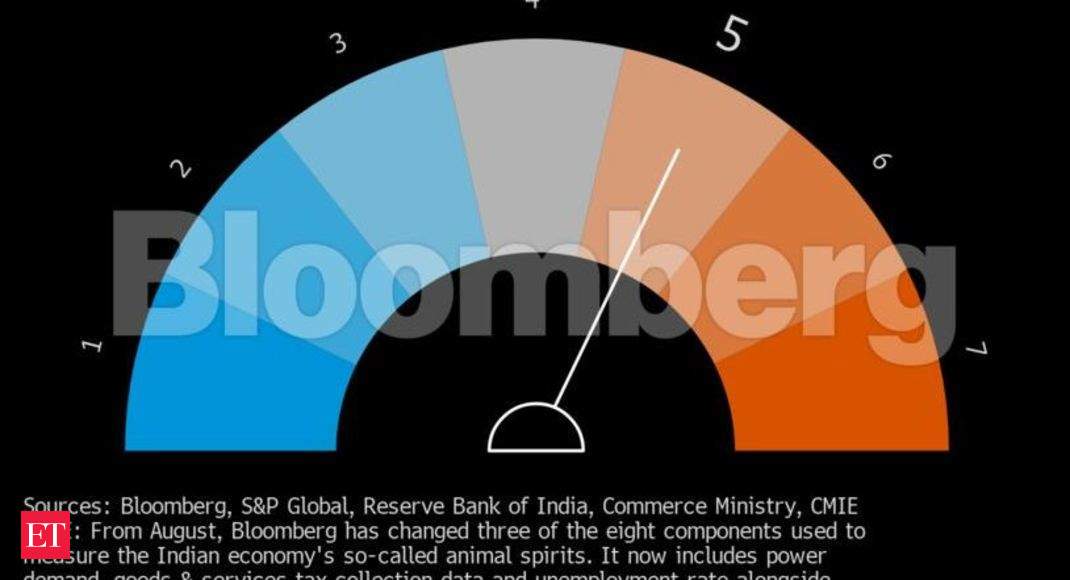

Nonetheless, the needle on a dial measuring total exercise was unchanged from July, because the gauge makes use of a three-month weighted common to easy out volatility within the single month readings.

The regular tempo of exercise is predicted to present financial coverage makers the boldness to proceed elevating rates of interest to combat above-target inflation after they meet later this month. The Reserve Financial institution of India, which has raised rates of interest by a complete of 140 foundation factors in three strikes this yr, has stated it targets a smooth touchdown for the economic system the place development isn’t sacrificed an excessive amount of.

Enterprise Exercise

Buying managers’ surveys confirmed a rebound in S&P International India Composite PMI in August, thanks largely to a stronger growth in providers exercise amid an upturn in new orders and slower improve in enter prices.

Exports

Commerce deficit hovered near a document excessive final month as exports development was little modified from a yr in the past, whereas imports jumped practically 37%, in line with preliminary information from the commerce ministry. A 2.2% year-on-year drop in worth of non-petroleum exports in August weighed on the general efficiency.

Bloomberg

BloombergShopper Exercise

Financial institution credit score demand jumped 15.5%, probably the most since November 2013, regardless of rising rates of interest, information from the central financial institution confirmed, whereas liquidity within the banking system continued to be in surplus. That helped broadly help consumption exercise, underscored by a leap in month-to-month items and providers tax assortment. GST income in August got here in at 1.44 trillion rupees ($18 billion), in comparison with early days of the pandemic when collections fell to as little as 323 billion rupees.

Bloomberg

Bloomberg

Market Sentiment

Electrical energy consumption, a extensively used proxy to gauge demand in industrial and manufacturing sectors, confirmed exercise is selecting up. Numbers from India’s energy ministry confirmed peak demand met in August jumped to 185 gigawatt from 167 gigawatt a month in the past. Nevertheless, rising unemployment numbers tempered the general optimism, with information from the Centre for Monitoring Indian Economic system Pvt. exhibiting the jobless charge climbed to eight.3% — the very best degree in a yr. That exhibits the present tempo of growth isn’t sufficient to create jobs for the million plus folks becoming a member of the workforce each month.