[ad_1]

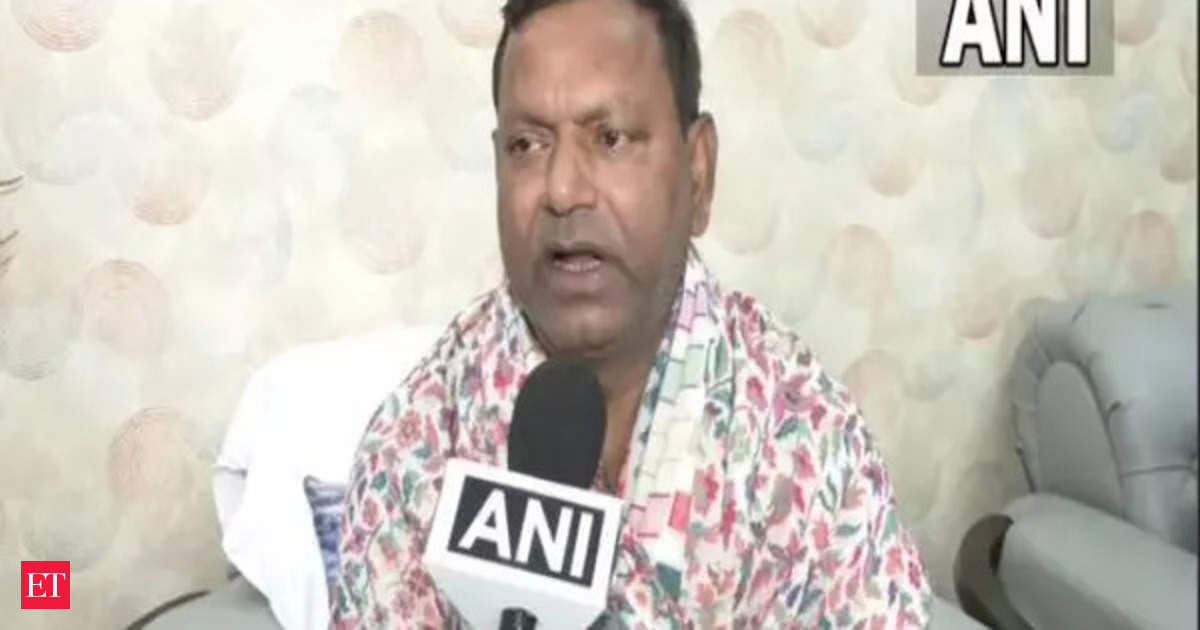

Minister of state for finance Pankaj Chaudhary, in a written reply within the Rajya Sabha, burdened that the danger profile of the debt “stands out as protected and prudent when it comes to accepted parameters of an indicator-based method for debt sustainability”. The federal government debt is held predominantly (about 95%) within the home forex, he stated, in search of to assuage fears of foreign exchange dangers.

Chaudhary stated per capita debt of the central authorities rose to Rs 58,709 as of March 2023 from Rs 29,127 in March 2012. He, nevertheless, added that the debt-to-GDP ratio (of the central authorities) is a “higher measure to replicate debt burden within the nation”.

The federal government, the minister asserted, has initiated a lot of measures to maintain the debt at an affordable degree, which embrace “delicately balancing the necessity for broad-based and sustained financial revival and financial consolidation”. It has pledged to cut back the fiscal deficit to a degree under 4.5% of the GDP by FY26; it had hit 9.2% within the pandemic yr of FY21 and is estimated to drop to five.9% in FY24.

“Growing the buoyancy of tax income by means of improved compliance, enhancing effectivity and effectiveness of public expenditure, and augmenting productive effectivity of the economic system, amongst others, are the necessary measures taken by the Authorities to carry down the debt and strengthen the economic system,” Chaudhary stated.

The central authorities’s debt-to-GDP ratio had dropped to 52.3% in FY19 from 53.5% in 2011-12, earlier than spiking within the wake of the pandemic resulting from “measures taken by the federal government to offer aid to the weak sections of society and in addition resulting from decline in income technology throughout the time of COVID-19 pandemic”, the minister stated.