[ad_1]

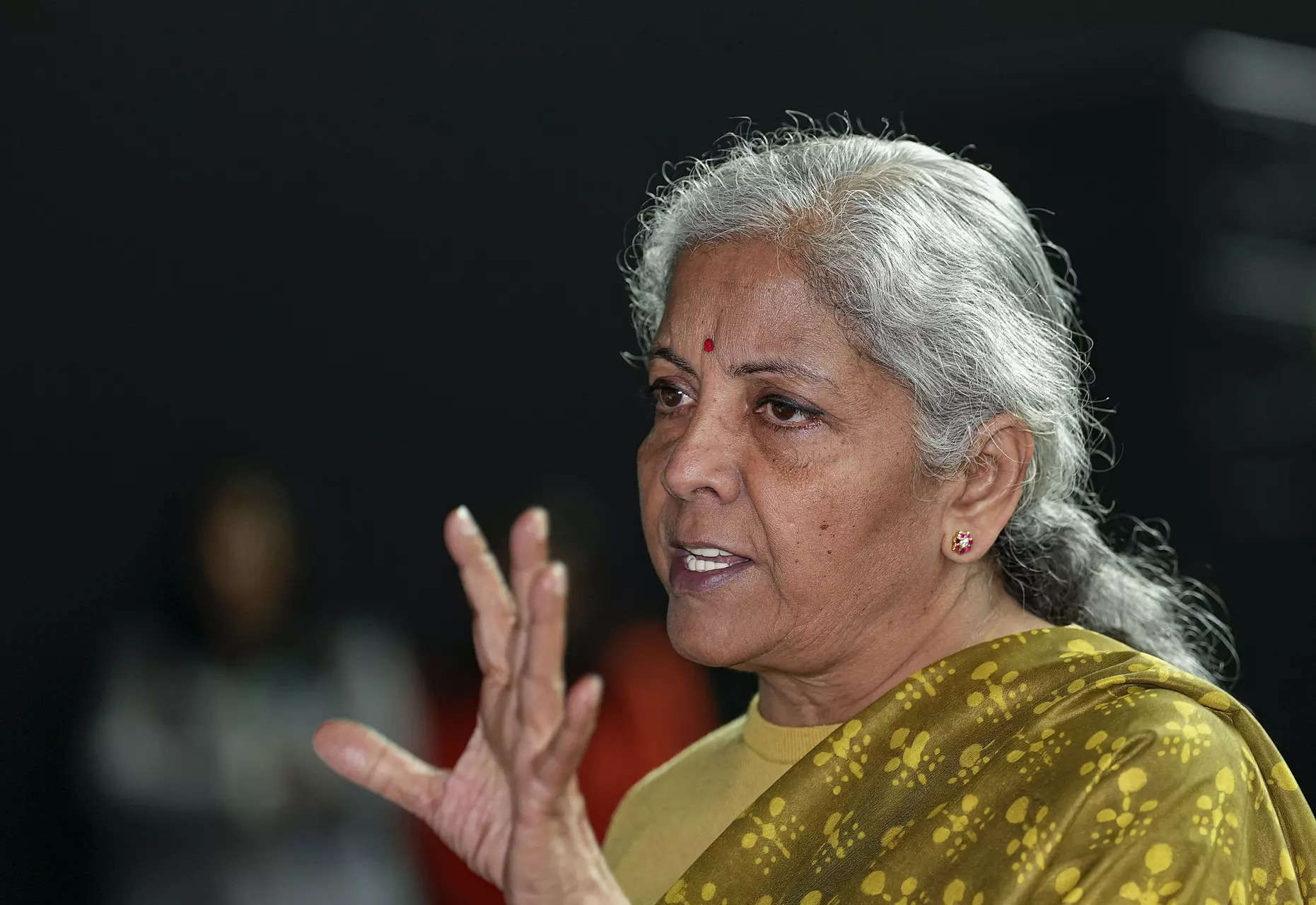

“A complete of 21,791 entities (11,392 entities pertaining to state tax jurisdiction and 10,399 entities pertaining to CBIC jurisdiction) having GST registration had been found to be non-existent. An quantity of Rs 24,010 crore (state – Rs 8,805 crore + Centre – Rs 15,205 crore) of suspected tax evasion was detected through the particular drive,” Sitharaman stated.

The minister was replying to a query on the variety of entities recognized as having pretend registrations, and the full quantity of evasion detected through the particular drive in opposition to pretend GST registrations carried out by the Central Board of Oblique Taxes and Customs (CBIC) from Might 16 to July 15, 2023.

To a question on whether or not the federal government has thought-about the challenges confronted by e-commerce enterprises in acquiring GST registrations, particularly working in digital areas, Sitharaman stated that contemplating the particular nature of e-commerce operators, a simplified process for registration of e-commerce operators has already been notified.

It supplies that when an e-commerce operator applies for registration in a selected state or Union Territory the place he/she doesn’t have a bodily presence, he/she will apply for registration by giving particulars of the principal place of work situated in one other state or Union Territory.

Additional, amendments have been made in GST Guidelines to strengthen the registration course of, together with biometric-based Aadhaar authentication, for high-risk registrants, together with the verification of the unique copy of the paperwork. A pilot undertaking for this was launched in Gujarat. In July, the pilot undertaking was prolonged to Puducherry and in November to Andhra Pradesh. Additionally, particulars of checking account, title and PAN of the registered individual are required to be furnished inside 30 days of the grant of registration or earlier than submitting of the assertion of outward provide, whichever is earlier.

Entities who don’t furnish the main points of legitimate financial institution accounts throughout the time interval prescribed will probably be suspended robotically by the system. Nevertheless, upon compliance with this provision subsequently, by the registered individuals such system-based suspension can be robotically revoked by the system.