[ad_1]

When Das was named because the governor on 12 December 2018, Patel had resigned citing private causes, however many believed it was an final result of the dispute over the switch of surplus reserves to the federal government and liquidity for non-banking corporations. Patel had resigned after months of bickering between the federal government and the RBI.

Das, a shrewd and in a position profession bureaucrat, was a far cry from superstar economist Rajan who minimize a larger-than-life determine and obtained well-known for saying, “My identify is Raghuram Rajan, and I do what I do,”, or a tutorial Patel who would jealously guard the autonomy of the RBI. Das was presupposed to heal the RBI-government ties and produce stability to a central financial institution that noticed excessive turbulence underneath his two predecessors.

Many will say Das has been pretty profitable in finishing up his temporary on the RBI.

What Das delivered to the RBI

Having labored equally comfortable underneath three totally different finance ministers — P Chidambaram, Pranab Mukherjee and Arun Jaitley — Das, a seasoned monetary bureaucrat, was seen as a bureaucrat who most well-liked to take a non-confrontational strategy to problem-solving. Das had performed an necessary position within the preparation of eight Union budgets — 4 as joint secretary and extra secretary in-charge of the essential funds division and two every as income and division of financial affairs secretary. Earlier than he joined the RBI, Das had been a key hyperlink in a number of essential financial choices since he moved to the finance ministry in 2008. Be it GST — the place he was a part of the grand cut price on a five-year compensation plan for states and the modification to the Structure for rollout of the brand new regime — or powerful negotiations with the Swiss authorities for data sharing on tax evaders, the Das emerged as a key troubleshooter, forging agreements. He was additionally chargeable for drafting the Insolvency & Chapter Code in addition to drawing up the contours of the Fugitive Financial Offenders Invoice and the regulation on black cash stashed abroad. If Patel, his controversial predecessor at RBI, was the creator of the MPC framework, Das was the person who applied it, by understanding amendments to the regulation in addition to setting the inflation goal.Because the financial affairs secretary, Das was the important thing man behind the planning and execution of demonetisation drive. A lot of the public statements on demonetisation had been made by him which led to the impression that the federal government was on the forefront of the drive as an alternative of the RBI.

A 1980-batch IAS officer of Tamil Nadu cadre, Bhubneswar-born Das was additionally chargeable for Tamil Nadu’s profitable SEZs and industrial coverage. He withstood political strain to allot authorities land to personal IT corporations in Tamil Nadu with out a bidding course of. Das was seen as a cautious civil servant however he didn’t draw back from powerful choices equivalent to dismantling the International Funding Promotion Board to hurry up clearances.

A difficult profession

The primary main problem for Das was to bridge the variations that had widened between the central financial institution and the federal government whereas additionally upholding the credibility and autonomy of the central financial institution. Das, a consensus-maker, readily took to the job of normalising ties with the federal government and was profitable at it. Das took a extra conciliatory strategy towards banking sector rules in comparison with his predecessor. He met with bankers to listen to their issues about liquidity constraints within the economic system, and gave extra leeway to small and medium enterprises with regard to their mortgage repayments.

Consultants noticed a softer strategy in direction of central financial institution regulatory supervision with the choice by the RBI to take away plenty of public sector banks from the strict lending restrictions comparatively quickly after the Das’ appointment.

However Das was to face far greater challenges forward when he could be required to steer the economic system by means of excessive turbulence: Covid lockdowns, provide chain disaster and the Russia-Ukraine warfare.

Barely a 12 months after Das took cost because the RBI governor, Covid hit the world. As a key financial policymaker, Das confronted difficult instances in managing the disruptions brought on by the lockdown. He selected to chop the coverage repo fee to a historic low of 4 per cent, persevering with with the low-interest fee regime for fairly a while to assist the economic system hit badly by lockdowns. The GDP development noticed restoration as a result of low-interest fee regime.

When Das was reappointed because the governor in 2021 for one more three years. it was seen as an expression of confidence in his insurance policies.

In Might 2022, the RBI introduced a shock 40 foundation level rate of interest hike, the primary in practically 4 years because the Russia-Ukraine warfare triggered fears over over world inflation. The charges had reached a document 4 per cent low after the RBI underneath Das went on a rate-cutting spree after the pandemic struck in early 2020. The RBI hiked the repo fee by 250 bps factors until April this 12 months when it paused the rate-raising cycle. Das’ remark that the RBI retains an Arjuna’s eye on inflation attracted a lot commentary on the impression of the RBI’s coverage on the growth-inflation dynamic.

“It was in managing [the Covid] disaster that Das had maybe his biggest impression, showing as a voice of calm amid the concern, and steering the RBI deftly between intense political pressures on one aspect and financial catastrophe on the opposite,” famous Central Banking, the publication that gave Das the Governor of the Yr award in March this 12 months. In September, Das has obtained an A+ ranking within the International Finance Central Banker Report Playing cards 2023.

The truth that regardless of all the worldwide shocks India has been capable of obtain a excessive development fee, uncommon amongst giant economies, on this interval whereas additionally having inflation average compared to different economies goes to indicate the success of Das-led RBI in making certain macroeconomic stability in extremely turbulent instances. India has shined as an exception on the planet when many huge economies have been fighting excessive inlfation and low development.

Das introduced humility to the RBI

Das had carried out a grasp’s diploma in historical past from Delhi’s St Stephen’s School. Although he had performed a key position in monetary policy-making on the Centre for a very long time, many had doubted Das’ potential to steer the central financial institution for his schooling in historical past as an alternative of finance or economics as was the case along with his two extra illustrious predecessors. However Das has proved {that a} governor’s job is just not as a lot about historical past or economics as about what it’s presupposed to be: the governance.

Das is a person of measured language not like his many predecessors who got to precise themselves freely and never typically with out dramatic impact. He is aware of the facility of an RBI governor’s phrases whose one free remark can transfer markets.

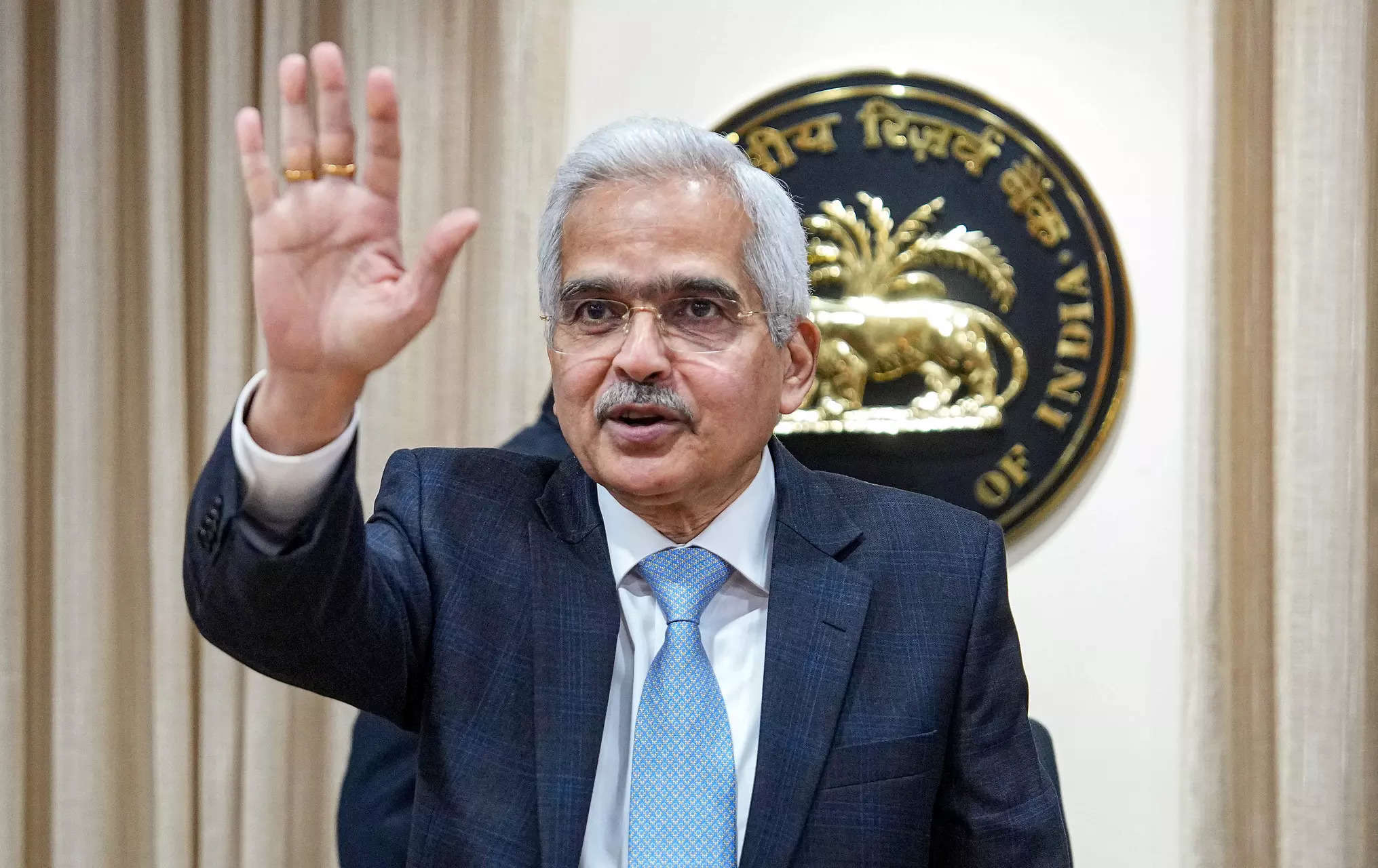

Compared to his two predecessors throughout whose tenure the RBI-government ties deteriorated, Das is a humble man who does not minimize a larger-than-life determine. Final week at a press convention, Das advised a junior workers to deal with him with out the “honourable” prefix, and name him simply “governor” as an alternative. “I believe in future, simply ‘governor’ shall be higher than ‘honourable governor’,” he stated. Das is aware of, and other people have seen throughout his 5 years on the RBI, that it is not as a lot the particular person because the position that issues.

(With inputs from TOI and businesses)