[ad_1]

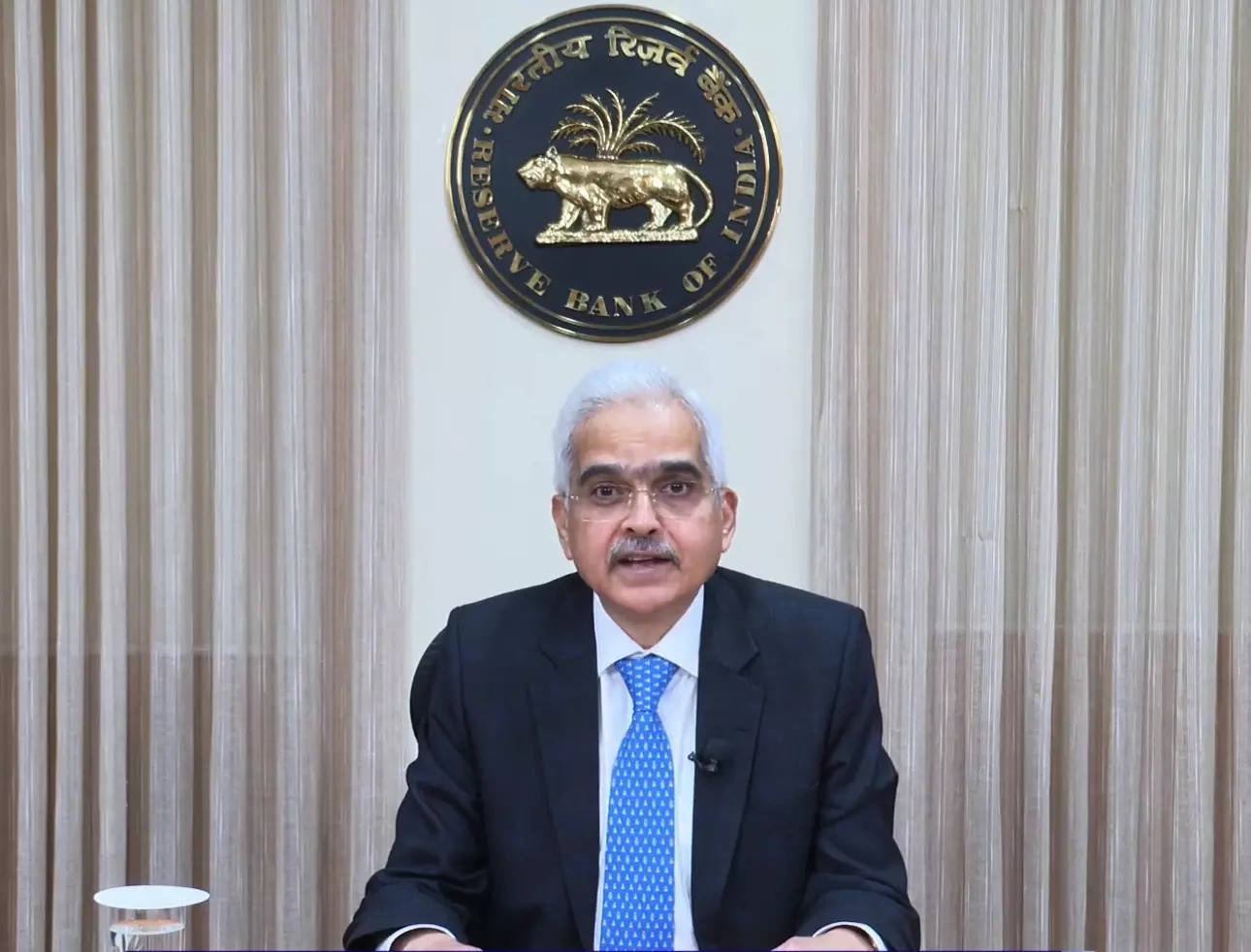

RBI Governor Shaktikanta Das will announce the selections of MPC’s final bi-monthly assembly of FY24, which started on February 6, on Thursday.

In line with an ET Ballot of 12 economists, there will not be important price changes. Nonetheless, some economists counsel {that a} fiscally prudent interim price range and indications of world financial easing may compel the central financial institution to tweak its stance on tight liquidity, which has pushed borrowing prices above coverage charges.

Whereas opinions differ amongst respondents, with two respondents predicting a shift in stance to ‘impartial’ from the present withdrawal of ‘lodging’’, a number of counsel that the RBI’s language might point out a rising tolerance for alleviating liquidity situations.

“We anticipate the committee to keep up the financial coverage stance pointed in direction of a withdrawal of lodging regardless of deficit liquidity situations, however the communication is more likely to flip materially much less hawkish,” Rahul Bajoria, head of rising markets Asia economics, Barclays, instructed ET.

Time to accommodate a impartial stance?

A impartial financial coverage stance permits the RBI to be extra versatile in managing liquidity. This implies they will modify monetary situations both by loosening or tightening them. At present, the main focus is on reversing the accommodating situations, which implies the RBI is making an attempt to scale back the amount of cash in circulation.When the RBI is extra ‘accommodative’, it means they’re rising the cash provide to stimulate financial development. Throughout the COVID-19 disaster in 2020-21, the RBI pumped in some huge cash into the banking system to maintain borrowing prices low and encourage spending.In April 2022, the RBI began shifting away from the accommodating stance. Consequently, over the previous six months, there was a scarcity of funds within the banking system. Banks have been borrowing closely from the RBI, reaching a multi-year excessive of over Rs 3 lakh crore in January.

Struggle in opposition to inflation continues

Whereas retail inflation has decreased from its peak of seven.44 per cent in July 2023, it stays comparatively excessive, standing at 5.69 per cent in December 2023. Nonetheless, this determine nonetheless falls throughout the Reserve Financial institution’s consolation vary of 4-6 per cent.

RBI’s Das and his staff will keep a vigilant method in direction of inflation, matching the Arjuna eye.

In line with a report by the State Financial institution of India (SBI), the RBI is anticipated to uphold its stance of pausing any additional coverage modifications within the upcoming assembly

“Sturdy US non-farm payroll knowledge and wages appear to have pushed again on market expectations for a fast pivot to price cuts,” it stated, and added the primary price lower on the desk may very well be from June to August interval “appears to be like the most effective wager now”.

On expectations from the coverage, Raoul Kapoor, Co-CEO of Andromeda Loans, stated the RBI is anticipated to keep up the present rates of interest. “This resolution is primarily influenced by the persistent problem of excessive retail inflation, which stays uncomfortably near the higher restrict of the RBI’s inflation goal at 6 per cent. The present inflationary pressures necessitate a cautious method,” PTI quoted him as saying.

Madan Sabnavis, Chief Economist, Financial institution of Baroda, stated the MPC is more likely to keep an unchanged method when it comes to each price and stance.

“That is in order inflation, as per the December knowledge, remains to be excessive and there are pressures on the meals facet. That is however the truth that core inflation has come down,” he stated.

Cues from Sitharman’s Fiscal Prudence Roadmap

Will probably be essential to look at how the RBI aligns itself with finance minister Nirmala Sitharaman‘s fiscally prudent price range, unveiled on February 1, 2024.

In her sixth price range, Sitharaman aimed to scale back the fiscal deficit goal to under 4.5 per cent of the GDP by 2025-26, setting it at 5.1 per cent for 2024-25, decrease than the revised 5.8 per cent for 2023-24.

India’s purpose is to slender the price range shortfall, counting on optimistic tax income projections regardless of elevated spending in an election 12 months, as Prime Minister Narendra Modi seeks a 3rd consecutive time period.

Sitharaman emphasised continued fiscal consolidation throughout her price range speech, focusing on a fiscal deficit of 5.1 per cent of GDP for 2024-25. This decrease deficit purpose is anticipated resulting from anticipated robust tax collections, rationalized expenditures, and diminished spending on subsidies.

Moreover, Sitharaman proposed a big 11.1 per cent improve within the capital expenditure goal to a historic Rs. 11.11 lakh crore for the following fiscal 12 months. This transfer goals to stimulate demand and consumption within the financial system, which aspires to turn into the world’s third-largest by 2030.

(Now you can subscribe to our Financial Instances WhatsApp channel)