[ad_1]

If RBI does not tinker with the charges, the important thing lending price can be saved unchanged for the seventh consecutive time by the central financial institution committee.

The repo price is the speed at which the RBI lends to banks.

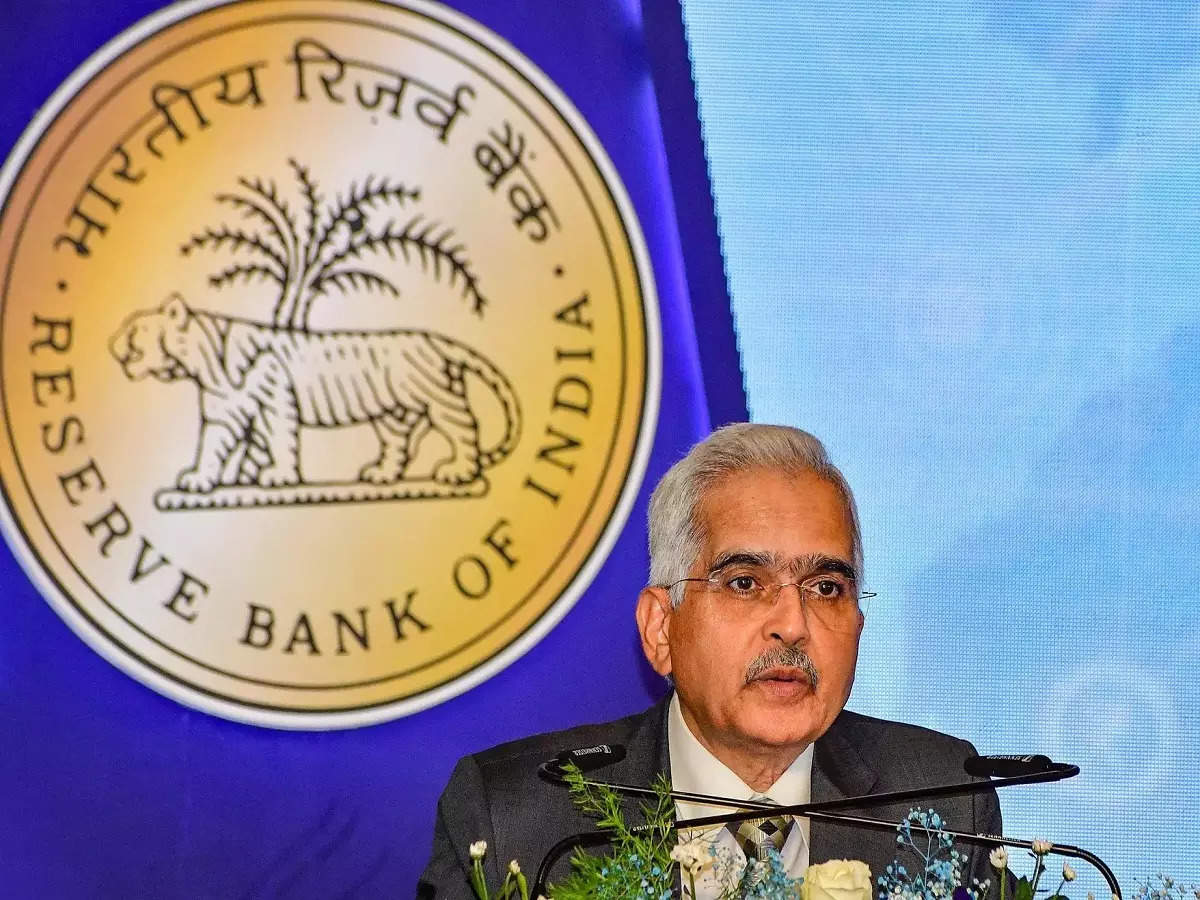

RBI governor Shaktikanta Das is scheduled to announce the choice of the bimonthly assembly, which commenced on Wednesday i.e. April 3, on April 5 at 10 am.

An ET ballot of 14 respondents instructed that the MPC is prone to retain each the repo price and stance on this assembly.

“Within the upcoming RBI coverage assembly on Friday, we count on the central financial institution to maintain its coverage price unchanged at 6.5 per cent,” HDFC Financial institution mentioned in its report on MPC expectations. “The timing of the change in stance stays a detailed name between the April or June coverage,” it additional said.Rains and warmth wave

Because the summer season season units in, the Financial Coverage Committee (MPC) would possibly grapple with considerations over impending rains and warmth waves. Aditi Nayar, the chief economist at ICRA, anticipated that the coverage stance will stay unchanged till there may be readability on the monsoon outlook. She instructed that any alterations are unlikely earlier than the August 2024 MPC assessment, awaiting visibility on the monsoon’s efficiency, sustained development momentum, and choices by the US Federal Reserve.

“The coverage stance is unlikely to be modified earlier than the August 2024 MPC assessment, till there may be visibility on the monsoon turnout, the sustenance of the expansion momentum and the US Fed’s price choices,” mentioned Nayar.

Nayar additional instructed that the earliest price reduce could solely happen within the October 2024 assembly.

Echoing comparable sentiments, a majority of respondents in an ET survey predicted a established order on the RBI’s financial coverage stance of ‘withdrawal of lodging’. They imagine the central financial institution would favor to observe the monsoon’s progress earlier than contemplating any shift in the direction of a softer financial coverage.

India braces for excessive warmth in the course of the April to June interval, notably impacting the central and western peninsular areas, based on the India Meteorological Division (IMD). The potential warmth wavemay doubtless affect the agricultural economic system, resulting in inflationary pressures as commodity costs rise.

Expectations on inflation, development entrance

RBI Governor Das has persistently emphasised the central financial institution’s dedication to driving inflation all the way down to the 4 p.c goal. Regardless of risky meals inflation in February, core inflation, excluding meals and gas, has proven a downward pattern. Nevertheless, considerations persist relating to the affect of climate variations on inflation and financial stability.

Barclays’ Rahul Bajoria highlighted that whereas core inflation could present some consolation, discussions could revolve round provide dangers, particularly contemplating international geopolitical tensions within the Pink Sea and ongoing weather-related variations. He anticipated a coverage method that maintains the established order amidst these uncertainties.

“On inflation, there can be a number of consolation round core inflation, however they could speak about provide dangers, notably from the worldwide scenario, the geopolitical tensions within the Pink Sea, and the weather-related variations that proceed. It will be a coverage that can be very ‘standing quoist’,” ET bureau quoted Bajoria, head of rising markets Asia economics, Barclays, as saying.

“On the expansion entrance, we count on This autumn FY24 GDP development at 6.9 per cent y-o-y (vs. the implicit development for This autumn FY24 at 5.9 per cent from the second advance estimates) and the complete yr FY24 development at 7.9% vs. the second superior estimate of seven.6 per cent. For FY25, we count on GDP development within the vary of 6.3-6.5 per cent,” the HDFC report mentioned.

On the inflation entrance, the report mentioned, “we count on CPI inflation to average to 4.6 per cent in FY25 from 5.4 per cent in FY24 assuming a traditional monsoon. We count on inflation to common at 4.3 per cent in H1 FY25 and thereafter stay within the vary of 4.5 to five.0 per cent in H2 FY25 because the beneficial base impact fades.”

Madan Sabnavis, chief economist at Financial institution of Baroda, identified key inflation dangers together with dwindling reservoir ranges and value hikes by fast-moving shopper items firms. Moreover, he highlighted persistently elevated inflation in sectors like training.

Current reviews from the Asia-Pacific Financial Cooperation Local weather Centre instructed that India might expertise above-average rainfall throughout July-September, additional complicating the inflation outlook.

Referring to the idea of “Goldilocks” very best state of secure financial development, Barclays economists, as reported by Reuters, emphasised the necessity for the RBI to steadiness dangers between over-tightening and sustaining circumstances for reaching sturdy actual GDP development, probably round 7.0 p.c.

Finance Minister Nirmala Sitharaman indicated robust financial efficiency, with GDP development surpassing 8 p.c for the primary three quarters of FY24. This pattern is anticipated to proceed, prompting some economists to anticipate an upward revision within the RBI’s development projection for FY25. Beforehand, the central financial institution had projected GDP development at 7 p.c for FY25.

Though shopper value inflation barely eased to five.09 p.c in February, Goldman Sachs expects a modest enhance to five.2 p.c in March on account of larger costs of greens and pulses.

Analysts eagerly await revisions in GDP forecasts, contemplating the better-than-expected development efficiency in FY24.

India recorded a sturdy 8.4 p.c financial development within the December quarter of fiscal 2023-24, with revisions upward in GDP estimates for the previous quarters by the Nationwide Statistical Workplace (NSO).

Key numbers from the final assembly

- RBI MPC determined to maintain the repo price unchanged at 6.5 per cent

- RBI had forecast the Indian economic system to develop at 7 per cent in FY25.

- Forecast every of the quarters in FY25 to develop at 7.2 per cent, 6.8 per cent, 7 per cent and 6.9 per cent respectively.

- CPI Inflation projection for FY25 at 4.5 per cent.

- RBI left its inflation forecast for this fiscal yr unchanged at 5.4 per cent.

- Q3FY24 and Q4FY24 GDP development charges pegged at 6.5 per cent and 6.0 per cent respectively.

- Actual GDP development price for Q1FY25, Q2FY25 and Q3FY25 pegged at 6.7 per cent, 6.5 per cent and 6.4 per cent respectively.

- Repo price determination wasn’t unanimous this time; 5:1. Prof. Jayanth R. Varma voted for a change in stance to impartial.