[ad_1]

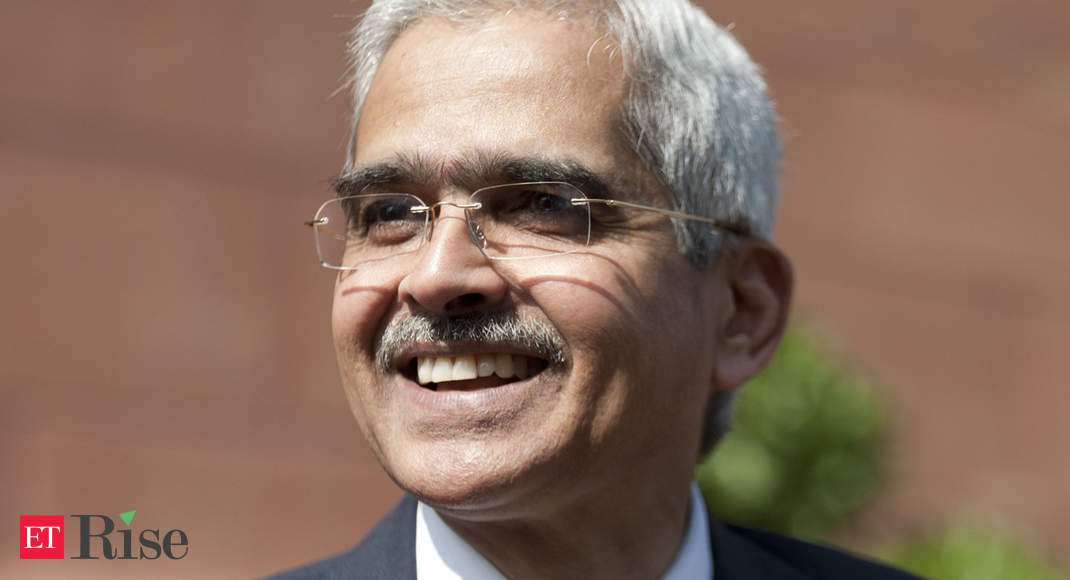

Efficient regulation is a precedence for the Reserve Financial institution, and regulation mustn’t constrain innovation within the fintech house, the governor stated at Occasions Community India Financial Conclave.

The governor additionally stated that sustaining banking sector well being with sturdy capital base and ethics-driven governance stays a coverage precedence.

Underlining the large position that expertise and innovation performed in serving the shoppers higher and quicker, Das stated the RBI processed 274 crore digital transactions to offer direct profit switch to individuals, most of which occurred through the pandemic.

“Since RTGS, which together with NEFT has been made around the clock now, has multi-currency capabilities, there’s scope taking it past our shores,” the governor stated.

Regardless of its official opposition to the non-public crypto currencies, Das stated the central financial institution is assessing monetary stability issues as it really works on approach forward for central financial institution digital foreign money.

The central financial institution chief additionally stated that the RBI is dedicated to utilizing all coverage instruments to assist the financial restoration whereas preserving worth stability and monetary stability.

Admitting that the spike in new pandemic infections is a matter of concern, Das, nonetheless, stated the nation is provided with extra insurances this time to deal with the afflictions.

Obtain The Financial Occasions Information App to get Every day Market Updates & Dwell Enterprise Information.