[ad_1]

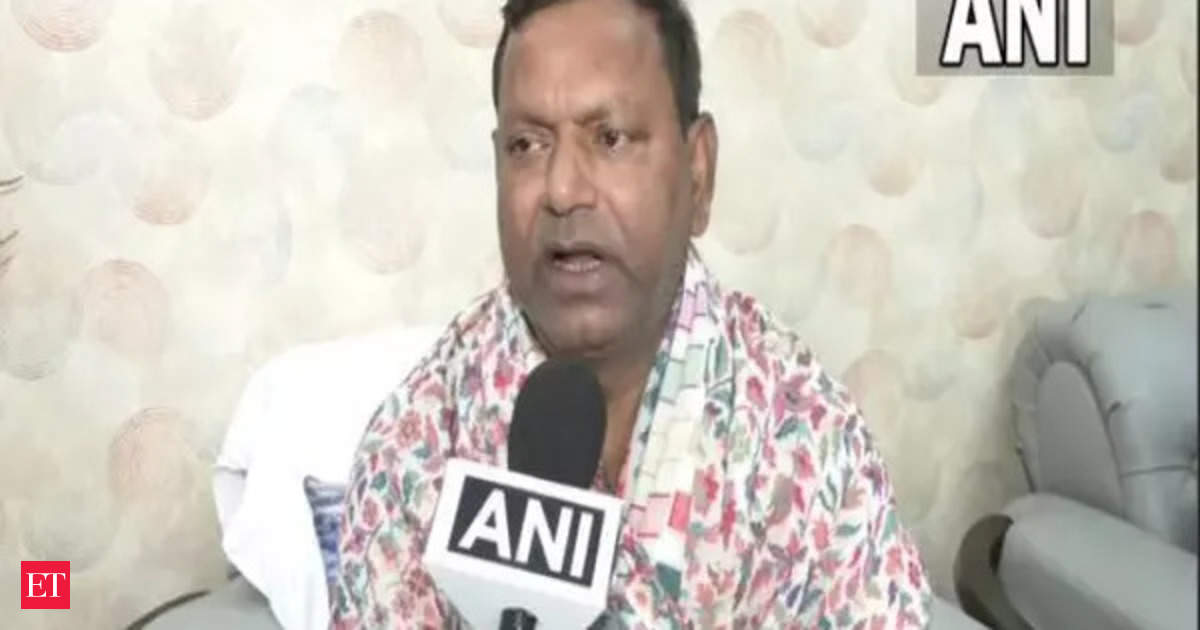

In a written reply, minister of state for finance Pankaj Chaudhary mentioned the influx have been impacted by the “risk of worldwide recession, financial disaster as a result of Russia-Ukraine battle, international protectionist measures and decline of actual GDP development charges of Singapore, USA and UK that are the main supply nations for FDI”.

FDI fairness inflows, too, eased practically 24% within the first half of this fiscal to $20.49 billion, he mentioned.

Gross FDI usually contains FDI fairness, reinvested earnings, fairness capital of unincorporated our bodies and different capital.

The FDI inflows into a rustic hinge on a raft of things, akin to the supply of pure assets, macro-economic stability, funding choice of international buyers, international funding local weather and central financial institution rates of interest, Chaudhary added.

He mentioned, to attract extra FDI inflows, the federal government has put in place an “investor pleasant” FDI coverage below which most sectors of the financial system, aside from sure strategically necessary sectors, are open to 100% international funding below the automated route.