[ad_1]

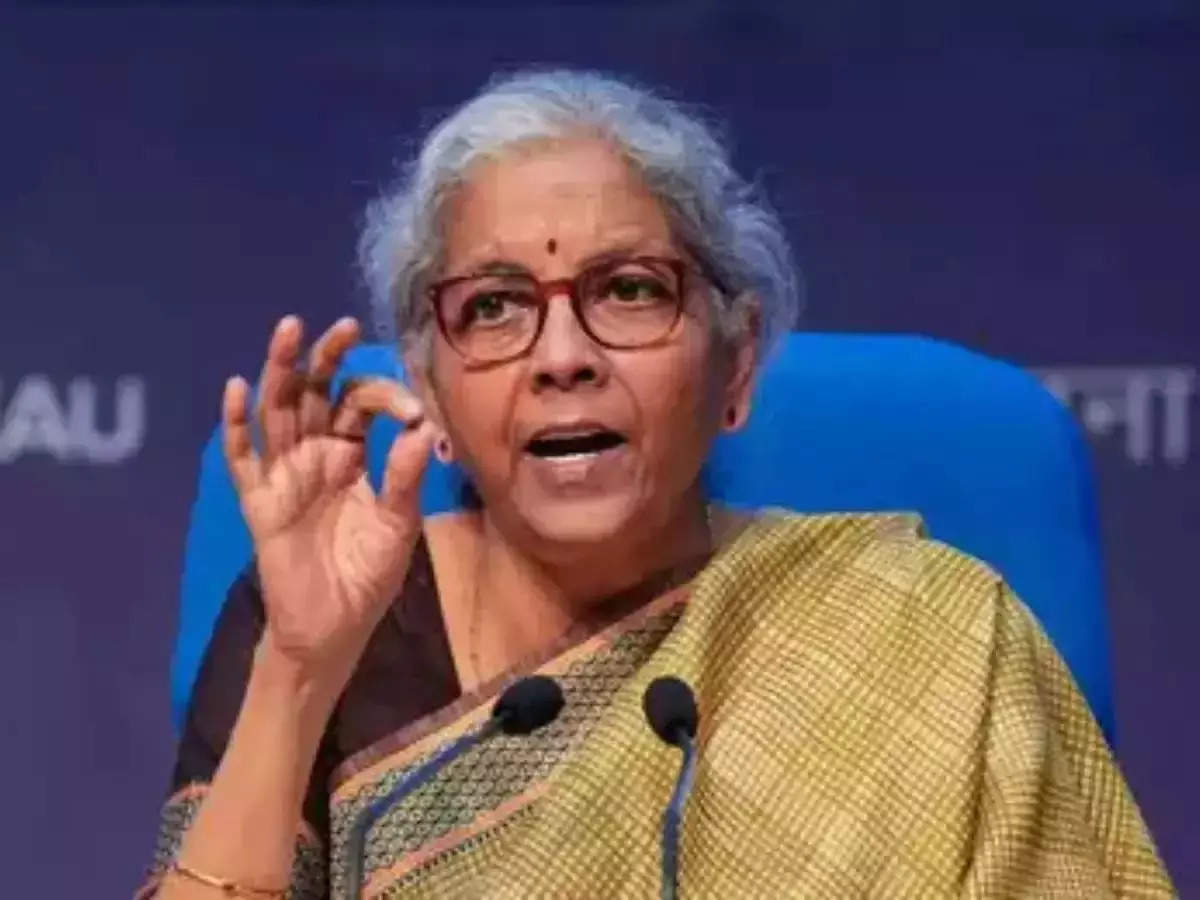

“The Union Finance Minister urged all of the GST formations to leverage know-how to plug the loopholes as nicely present higher taxpayer providers,” an official assertion issued after the assembly mentioned.

She additionally harassed that readability on the classification of associated points needs to be seemed into on the earliest by means of acceptable channels.

Sitharaman additionally exhorted the GST officers to interact with stakeholders to know their considerations, improve compliance, streamline processes, and work collaboratively in direction of making the tax system extra clear and environment friendly.

In her handle, Sitharaman harassed the importance of holding such conferences often amongst enforcement chiefs of the Centre and states, and to leverage this platform for discussing obstacles, exchanging profitable methods and collectively advancing in direction of a extra sturdy and harmonious tax infrastructure.

Income Secretary Sanjay Malhotra emphasised the essential position of enforcement in guaranteeing the success of the GST system. Malhotra outlined key priorities – concentrating on high-risk areas, combating tax evaders, balancing enforcement with taxpayer rights, strengthening collaboration between central and state authorities, and gathering suggestions for enchancment in coverage and technological interventions. Central Board of Oblique Taxes and Customs (CBIC) chairman Sanjay Kumar Agarwal mentioned that pretend entities and GST evasion not solely erode income but in addition distort truthful competitors and gasoline an underground economic system.

He highlighted the significance of robust information analytics, using know-how and the necessity to keep forward of the perpetrators of GST evasion.

Agarwal additionally reminded the officers to observe the directions issued by CBIC with respect to the process to be adopted throughout enforcement motion.

The nationwide crackdown on pretend registrations and bogus billing from Could 2023 alone has resulted within the detection of ITC tax evasion of Rs 49,623 crore, involving 31,512 bogus corporations.

CBIC officers have detected pretend ITC evasion of Rs 1,14,755 crore from the yr 2020 until date.

Throughout the convention, Maharashtra state GST officers mentioned they’ve recognized 41,601 suspected non-genuine taxpayers, out of which 6,034 NGTPs had been detected primarily based on numerous intelligence gathered throughout registration, e-way payments and inputs from CBIC/different states and outlined the steps taken to enhance detection charge at an early stage.

It was determined to conduct the Nationwide Convention of Enforcement Chiefs of State and Central GST Formations bi-annually transferring ahead, the assertion added.