[ad_1]

The reserves elevated by $2.95 billion.

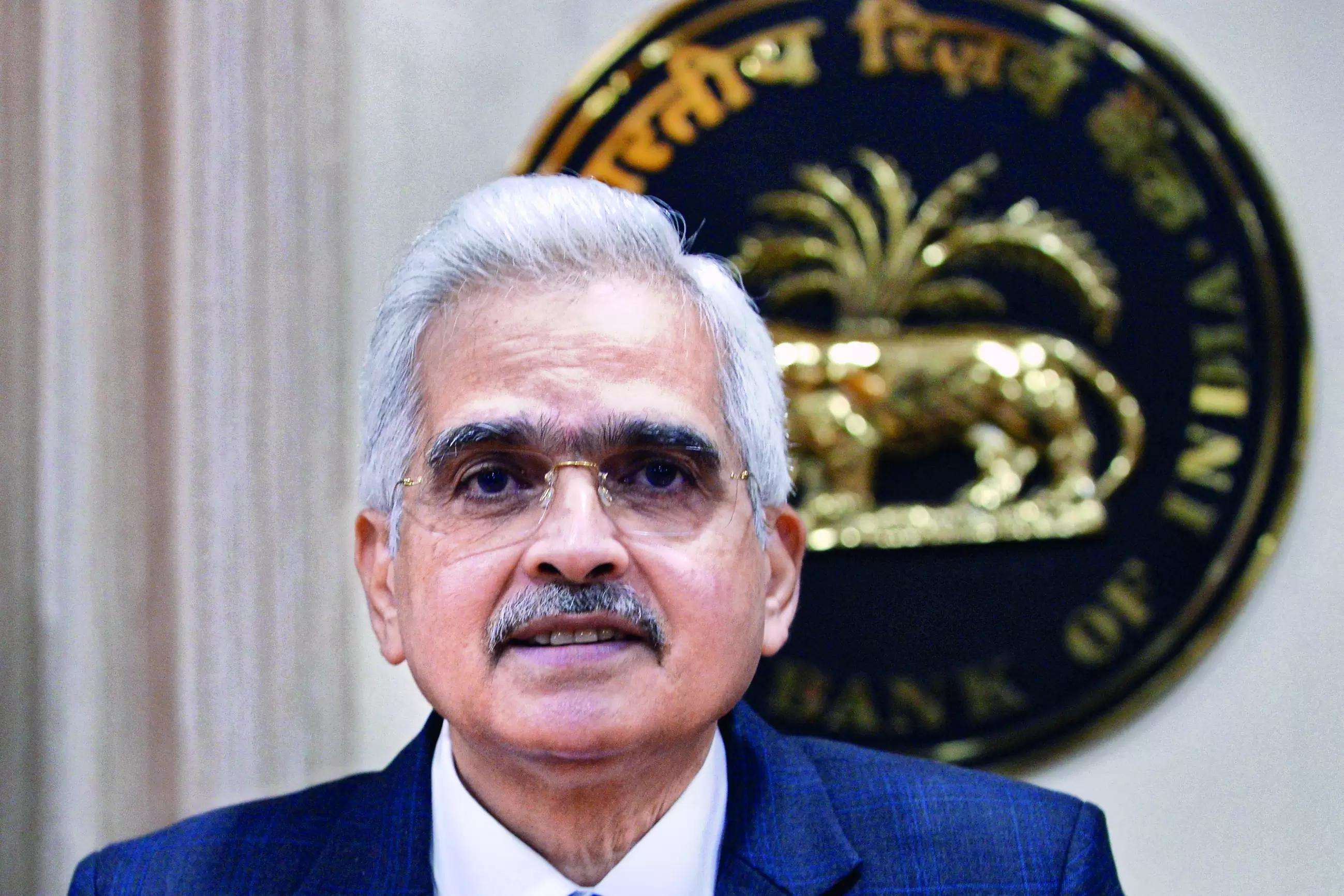

Newest knowledge on numerous exterior vulnerability indicators recommend improved resilience of India’s exterior sector, stated the RBI Guv and added, “We stay assured of assembly our exterior financing necessities comfortably.”

We’re constructing gold reserves that’s a part of our foreign exchange reserve deployment, stated the RBI Guv.

The Indian rupee was most secure in FY24 amongst main economies, Das stated. As in comparison with the earlier three years, the INR exhibited the bottom volatility in 2023-24.

The relative stability of the INR displays India’s sound macroeconomic fundamentals, monetary stability and enhancements within the exterior place, Das stated.Based on the Weekly Statistical Complement launched by the RBI, Overseas forex property (FCAs) surged by $2.35 billion to $570.62 billion. Expressed in greenback phrases, the FCAs embrace the impact of appreciation or depreciation of non-US items just like the euro, pound and yen held within the international change reserves.Gold reserves rose by $673 million to $52.16 billion, whereas SDRs had been down by $73 million to $18.15 billion.

Reserve place within the IMF decreased by $2 million to $4.66 billion.

Earlier, foreign exchange expanded by $140 million to $642.63 billion for the week closing on March 22.

Usually, the RBI, every now and then, intervenes available in the market by way of liquidity administration, together with by way of the promoting of {dollars}, with a view to stopping a steep depreciation within the rupee.

The RBI carefully displays the international change markets and intervenes solely to take care of orderly market situations by containing extreme volatility within the change fee, irrespective of any pre-determined goal degree or band.