[ad_1]

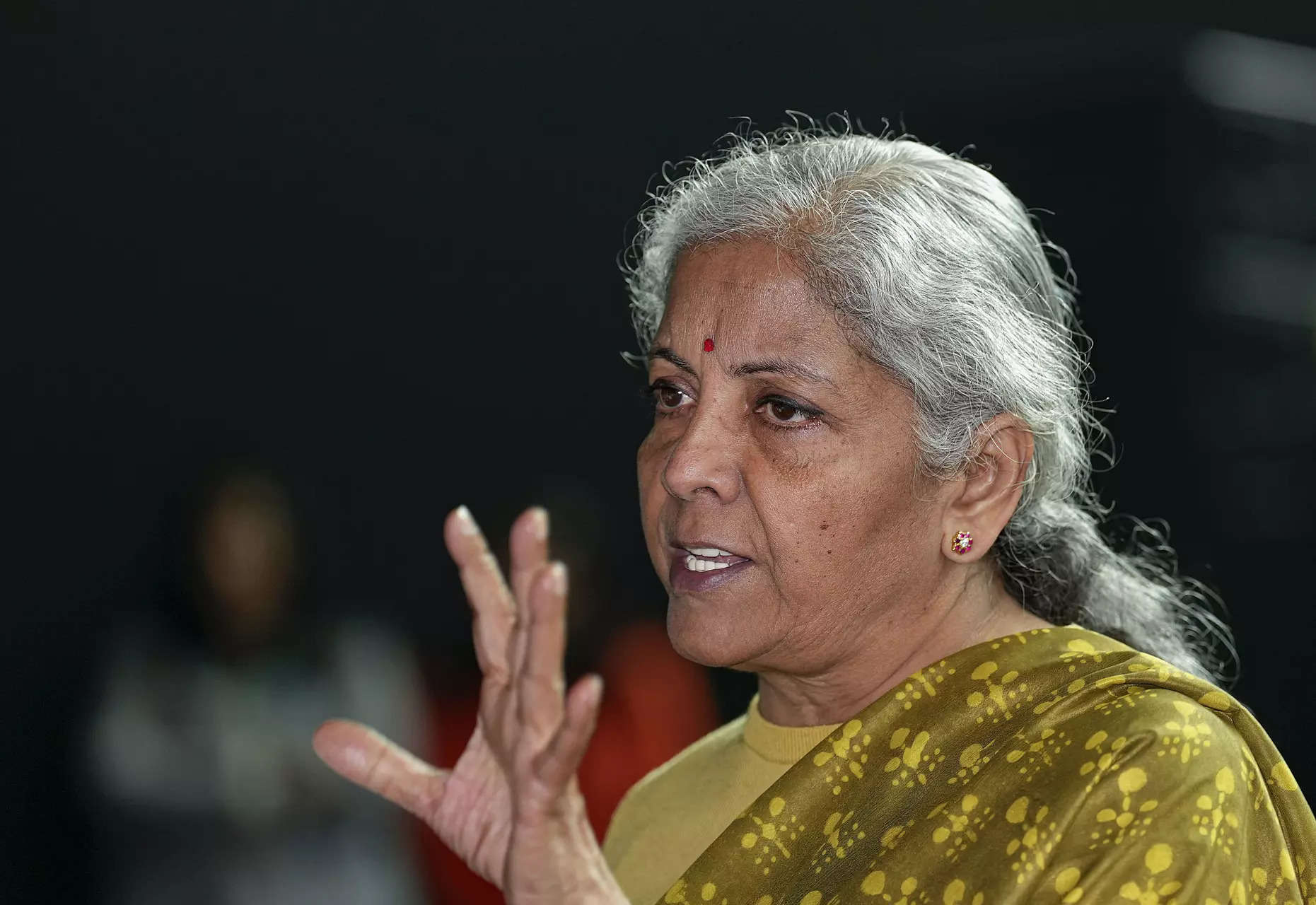

Taking part in a debate organised nearly by the India World Discussion board, Sitharaman mentioned traders “needn’t be jittery in any respect” in regards to the final result of basic elections due in April-Could 2024.

“…maintaining their (traders) fingers crossed is regular and I can perceive that. However, right here I’m and likewise, there are a number of people who find themselves observing the Indian financial system, observing the political setting, observing the bottom degree realities and the state of affairs because it prevails as we speak; Prime Minister Modi is coming again and coming again with an excellent majority,” she emphasised.

Earlier within the day, S&P World Scores raised India’s progress forecast for this fiscal 12 months to six.4% from 6%.

Sitharaman famous that indicators inside India are comfortably positioned due to secure insurance policies and predictable tax domains, however there are challenges within the type of weakening consumption within the West.

“Consumption is falling in lots of Western economies; it impacts me as a result of our exports are so depending on the European market or the superior economies’ market, the place demand is falling and exports might be adversely affected,” she mentioned. The finance minister famous that the continued excessive rate of interest regime adopted by the US Fed and inflationary pressures in many of the Western economies has a bearing on the stream of overseas investments into India, and the trade price, significantly for the Indian rupee versus the US greenback. This, she mentioned, is one other issue on which the federal government has to maintain a steady watch.