[ad_1]

Hugh Smachlo is an Import Coverage Analyst within the Enforcement and Compliance Business Monitoring and Evaluation Unit

Aluminum is a scorching commerce subject to observe in 2023. A brand new instrument is now out there to assist trade analysts observe knowledge and tendencies for the biggest aluminum importing and exporting international locations. This week, ITA launched the World Aluminum Commerce Monitor (GATM), the primary publicly out there knowledge visualization instrument for comparative evaluation that gives perception into the worldwide aluminum trade and its impacts on U.S. producers and importers.

Since 2001, the variety of main (non-recycling) aluminum smelters in the US has dwindled from 23 to five. Major aluminum smelters use unrecycled, uncooked materials to make high-purity aluminum utilized in almost each aluminum product, together with automobiles, infrastructure, aerospace, packaging, and client items. They’re a vital hyperlink in lots of of those provide chains.

A drastic discount within the variety of American aluminum smelters might erroneously point out that the U.S. demand for aluminum has dropped, or that the U.S. aluminum trade has suffered a dearth of funding; nevertheless, neither is the case. Since 2013, the U.S. aluminum trade has invested greater than $7 billion in home manufacturing, and world aluminum demand has spiked because of climbing curiosity in recyclable and light-weight supplies like aluminum.

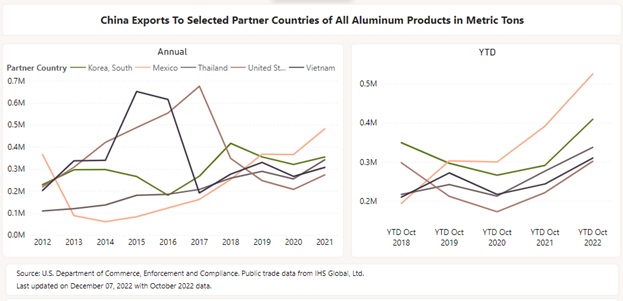

The newly launched GATM dashboard sheds mild on this situation by indicating the place there may be demand for aluminum. Amongst its hundreds of customizable charts, its “High Companion Nations” comparability characteristic permits customers to see aluminum import or export flows to or from a specific nation. Whereas globally China’s share of aluminum manufacturing elevated from 12% to 60% from 2012 to 2021, the GATM comparability instrument reveals that its aluminum exports had been concentrated in 5 international locations: the US, Vietnam, South Korea, Mexico, and Thailand. GATM reveals the ripple results of China’s voluminous world exports on the U.S. aluminum trade, which, paired with a rise in unfair commerce practices, precipitated the U.S. aluminum trade to hunt commerce treatments.

In 2021, primarily based on requests from the home aluminum trade and following rigorous investigations, Commerce put in place antidumping and/or countervailing obligation (AD/CVD) orders on frequent alloy aluminum sheet (CAAS) from 16 international locations, and AD/CVD orders on aluminum foil (foil) from 5 international locations. These commerce treatments construct upon the already current AD and/or CVD orders on CAAS and foil from China and provides the U.S. trade the chance to compete on a stage enjoying subject in opposition to unfair overseas pricing and subsidization.

GATM visualizations additionally present a glimpse into one other area’s rippling impression on the U.S. aluminum trade. Since 2012, the Center East has emerged as a significant aluminum-producing area because of an ample provide of low power prices and efforts there to diversify nationwide economies. For instance, on the primary tab titled “GATM,” customers can see that United Arab Emirates, Bahrain, and Oman’s complete exports to the U.S. elevated 190% between 2012 and 2018.

These two pictures, amongst the hundreds of publicly out there and customizable charts within the GATM, present mandatory context for understanding world aluminum commerce flows and their impression on the U.S. trade. Moreover, they assist to elucidate, partly, the standing of the U.S. as a internet importer of aluminum merchandise for every of the seven customary subcategories: bars, rods, and profiles; foil; pipes and tubes; plates, sheets, and strip; tube or pipe fittings; unwrought; and wire.

Making certain the aluminum trade has the information it wants, the GATM comes at a vital second for the US and for our aluminum trade and employees. The home aluminum trade instantly employs 164,000 American employees and not directly helps a further 470,000 employees, accounting for $73 billion {dollars} in U.S. financial output.

That is one among many instruments that ITA supplies U.S. firms to make knowledgeable choices primarily based on strong details about world markets.

For added info, please e-mail aluminum.license@commerce.gov.