[ad_1]

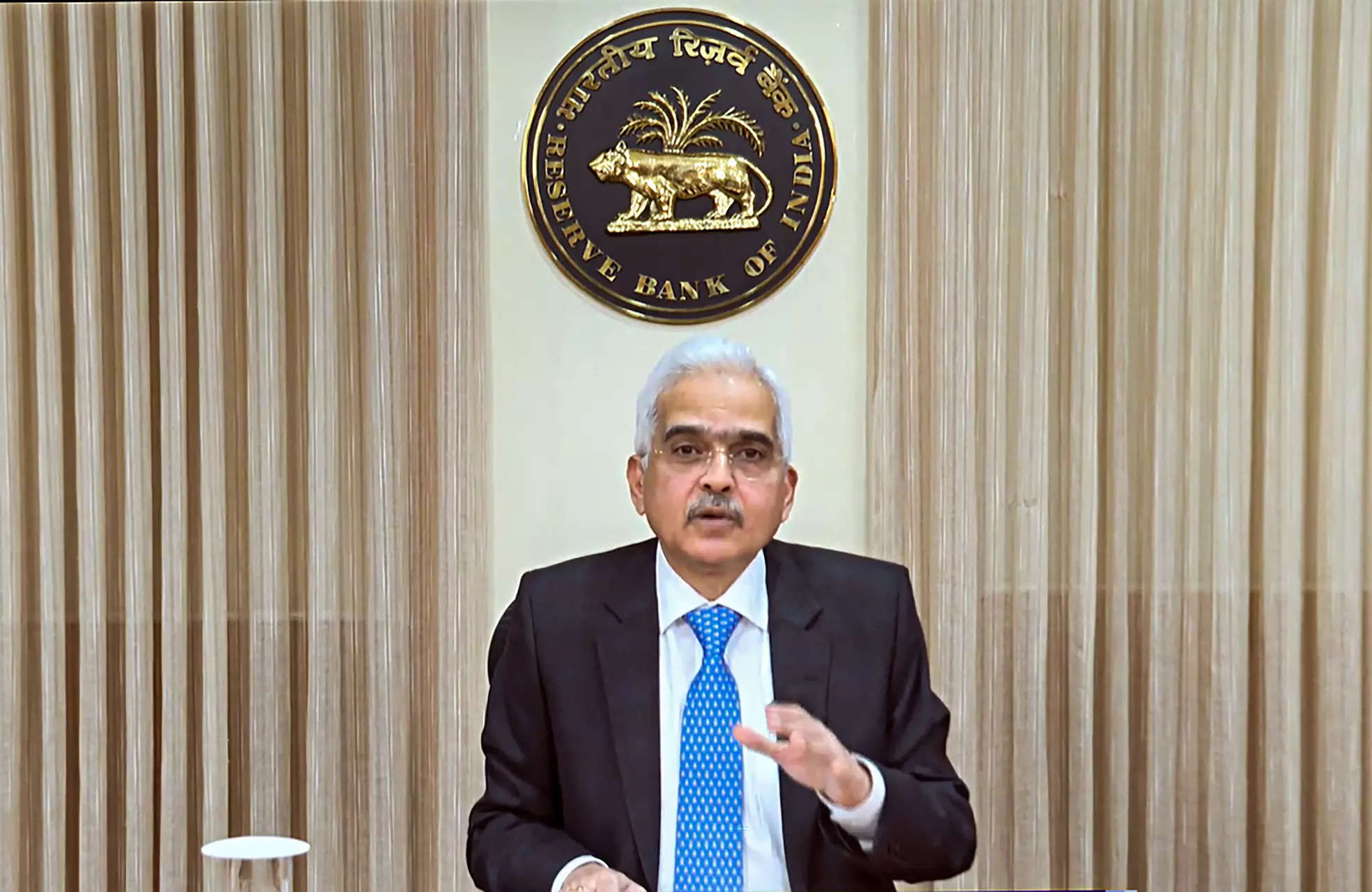

India might be an oasis on this planet hobbled with financial challenges, a situation the central financial institution must capitalize on to maintain inflation low on a sustainable foundation after having managed to cut back it from the height, stated RBI Governor Shaktikanta Das.

There are probably spillovers from international developments equivalent to excessive public debt in developed markets and an uncomfortable enhance in commodity costs together with crude oil costs brought on by provide constraints and geopolitics.

“ Two years in the past, round this time, the elephant within the room was inflation,’’ stated Governor Shaktikanta Das. “The elephant has now gone out for a stroll and seems to be returning to the forest. We wish the elephant to return to the forest and stay there on a sturdy foundation.’’

Whereas the Financial Coverage Committee (MPC) didn’t explicitly point out the worldwide rate of interest situation the place the Federal Reserve Chairman Jerome Powell was cautious about easing too early, it echoed the sentiment that easing at this juncture may undo the beneficial properties made.

Financial coverage should proceed to be actively disinflationary to align inflation to the goal of 4% on a sturdy foundation, he stated. An ET ballot of 14 respondents stated the MPC would preserve the repo price unchanged at 6.5%.The cracks within the MPC remained on issues equivalent to rates of interest and the financial stance, with each choices voted 5 to 1 because the panel retained its `give attention to the withdrawal of lodging.’ Exterior member J.R. Varma voted for a discount in rates of interest by 25 foundation factors. A foundation level is a hundredth of a share level.

The Repo price, the speed at which the central financial institution lends to banks will stay at 6.5% and so would be the different charges. Monetary markets had been little modified because it sought to decipher the tone of the Governor, with consultants believing that odds have now lengthened on price easing.

The Sensex fell 0.09% per cent to 74,162.70, whereas the rupee superior 5 paise to 83.40 per US greenback. Yield on the benchmark bond was one foundation level increased at 7.11%. A foundation level is 0.01 share level. Bond costs and yields transfer inversely.

`The important thing headline danger is coming from rising geo-politics which can also be getting evidenced in rising crude costs,’’ stated Anitha Rangan, economist at Equirus Capital, an funding financial institution. “The RBI has a view that home development momentum led by rural restoration, personal capex and authorities funding will stay sturdy into the 12 months.’’

Progress Forecast

The central financial institution retained the financial development forecast at 7% for the present monetary 12 months. It stated inflation will stay above the goal at 4.5%, delaying the easing of financial situations because it goals to align the studying on the worth gauge with the goal of 4% on a sturdy foundation.

“Shopper confidence one 12 months forward reached a brand new excessive,” stated Das. “The prospects of funding exercise stay shiny owing to an upturn within the personal capex cycle changing into steadily broad-based, persisting and strong authorities capital expenditure, wholesome stability sheets of banks and corporates.”

India’s Shopper Worth Index inflation was at 5.09% in February, regular versus 5.10% a month in the past, newest knowledge confirmed. In March, it’s estimated to return in at 4.9% as the federal government diminished costs of fuel cylinders, petrol and diesel forward of the elections.

“However the minimize in petrol and diesel costs in mid-March, the latest uptick in crude oil costs must be intently monitored,’’ stated Das. “Persevering with geo-political tensions additionally pose upside danger to commodity costs and provide chains.”

India’s financial system is on a roll, increasing on the quickest tempo amongst main markets with a growth in actual property, vehicle gross sales. However there are probabilities of spillovers that might adversely have an effect on the financial system.

“Worsening debt scenario in superior economies can generate spillovers within the type of swings in capital flows and volatility in monetary markets,” stated Das. “India, nonetheless, presents a special image on account of its fiscal consolidation and sooner GDP development.”