[ad_1]

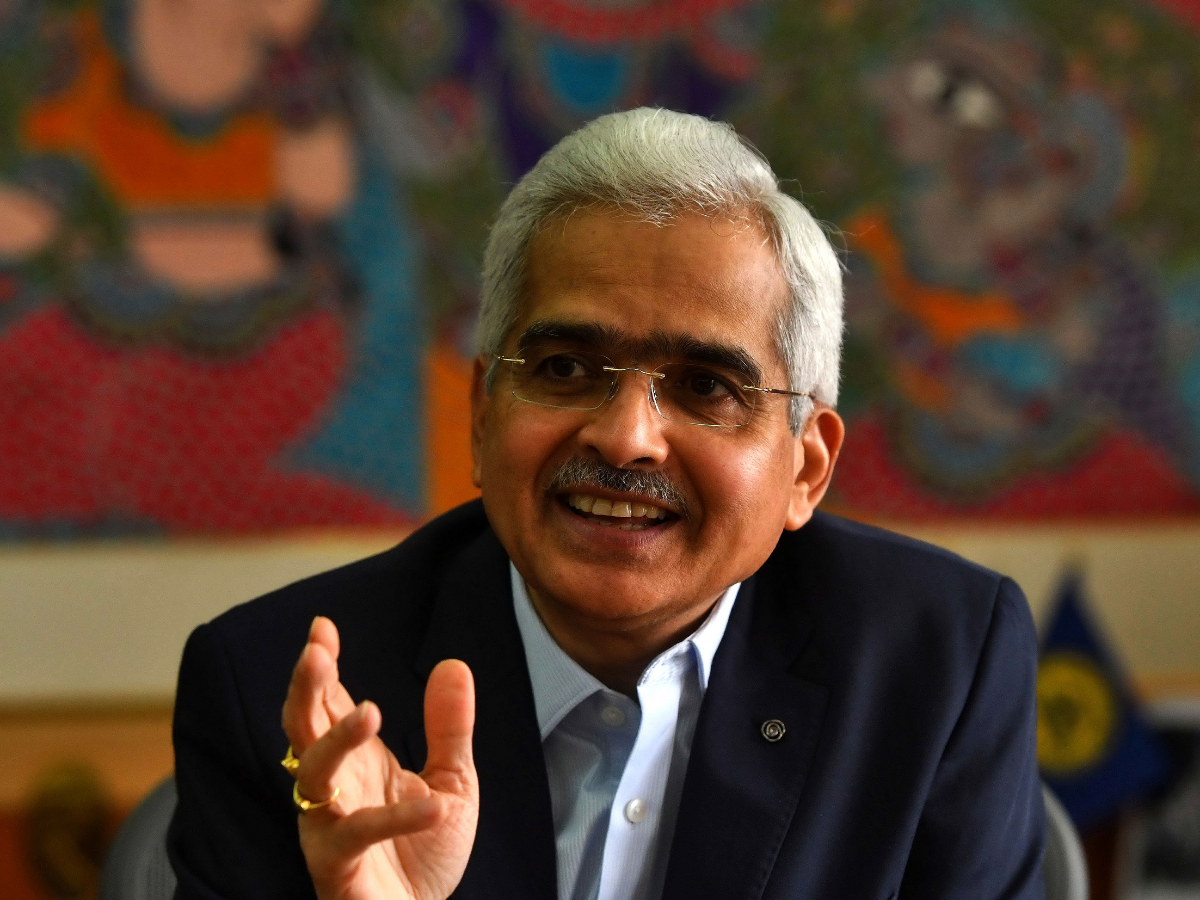

Das, who was talking at an occasion at Davos organised by the Confederation of Indian Trade on the event of the annual assembly of World Financial Discussion board, has additionally used the worldwide stage to make a case for central banks’ intervention to scale back trade fee volatility particularly in rising markets.

He stated that India’s current progress outturns have shocked most forecasts on the upside amid an unsure and difficult international macroeconomic setting.

“My sense is that the GDP progress in India will contact 7% in FY25. I’m saying this on the premise of the robust momentum of financial exercise seen in India,” Das stated Wednesday. If this projection comes true, FY25 would be the fourth consecutive yr of seven% plus progress since FY22.

India’s macro-economic and monetary stability was properly supported by a secure foreign money up to now few quarters, which was aided by common market intervention by the central financial institution.

“Extreme volatility must be checked via market intervention by the central financial institution, extra so in an rising market financial system,” Das stated, including that the rupee’s relative stability within the current interval was an final result of the energy of the Indian financial system, its macroeconomic fundamentals and enhancements in India’s exterior place, notably the numerous moderation within the present account deficit (CAD) and revival of capital flows on the again of comfy overseas trade reserves. It might be recalled that the Worldwide Financial Fund had in December final yr criticised RBI saying that the central financial institution’s intervention “possible exceeded ranges mandatory to deal with disorderly market situations”.Das on Wednesday stated that the rising market economies have the best to take steps to stabilise their markets as they had been on the receiving finish of extra volatility in US greenback and bond yields throughout the current interval of heightened uncertainty.

“In such a scenario, the EMEs, which have their very own home dynamics and challenges, can’t afford to be held hostage by worldwide monetary cycles,” the RBI Governor asserted.