[ad_1]

“Excessive rates of interest, fiscal correction after the largesse of the pandemic years, lingering lockdown associated friction in China, had been all on the right track to sap world financial momentum, with shadows over asset markets,” the report authored by DBS Chief Economist Taimur Baig, Senior Economist Radhika Rao, amongst others, famous.

Nevertheless, opposite to projections, the worldwide economic system has maintained relative stability this yr.

The US, the world’s largest economic system, is poised to finish 2023 with a stronger development charge than the previous yr. Equally, each China and India, as the 2 most populous economies, are anticipated to exhibit increased development charges by the year-end. Regardless of these constructive indicators, uncertainties loom giant, prompting contemplation concerning the financial panorama of 2024.

For 2024, DBS mentioned a number of questions return.

- Will the approaching yr be the one when, lastly, the worldwide economic system takes day trip from the submit pandemic restoration, burdened by the Federal Reserve’s charge hikes, and beset by the uncertainties emanating from China?

- Would geopolitical dangers spike additional, sapping enterprise confidence? May monetary markets flip unstable as liquidity tightens?

DBS thus considers three potential eventualities:

Comfortable Touchdown (60%) – The bottom case situation forecasts a gradual softening of demand within the US and the EU as a consequence of excessive rates of interest, however a recession is unlikely in these areas. In Asia, notably in China, efforts to rectify the property and tech sectors are underway, aiming to keep up development above 4%. The situation hinges on secure monetary sectors.

“Liquidity stays ample regardless of quantitative tightening, US treasuries stay nicely bid by the non-public sector, USD weakens, and commodity markets stabilise,” DBS mentioned.

No Touchdown (25%) – The likelihood of a no-landing situation has elevated. “A stroke of fine luck and good timing is required for this situation to pan out,” DBS mentioned.

Central banks won’t instantly ease charges, however as inflation dangers diminish, insurance policies may pivot in direction of leisure, enhancing consumption and funding sentiments.

Arduous Touchdown (15%) – Though assigned a decrease likelihood, a tough touchdown situation is not inconceivable, or as DBS says “one-in-six shouldn’t be a trivial proposition in any respect”. Persisting inflation strain, potential charge hikes, and monetary market turmoil may result in disorderly outcomes in debt markets. If central banks fail to mitigate rising charges, world financial dangers may rise.

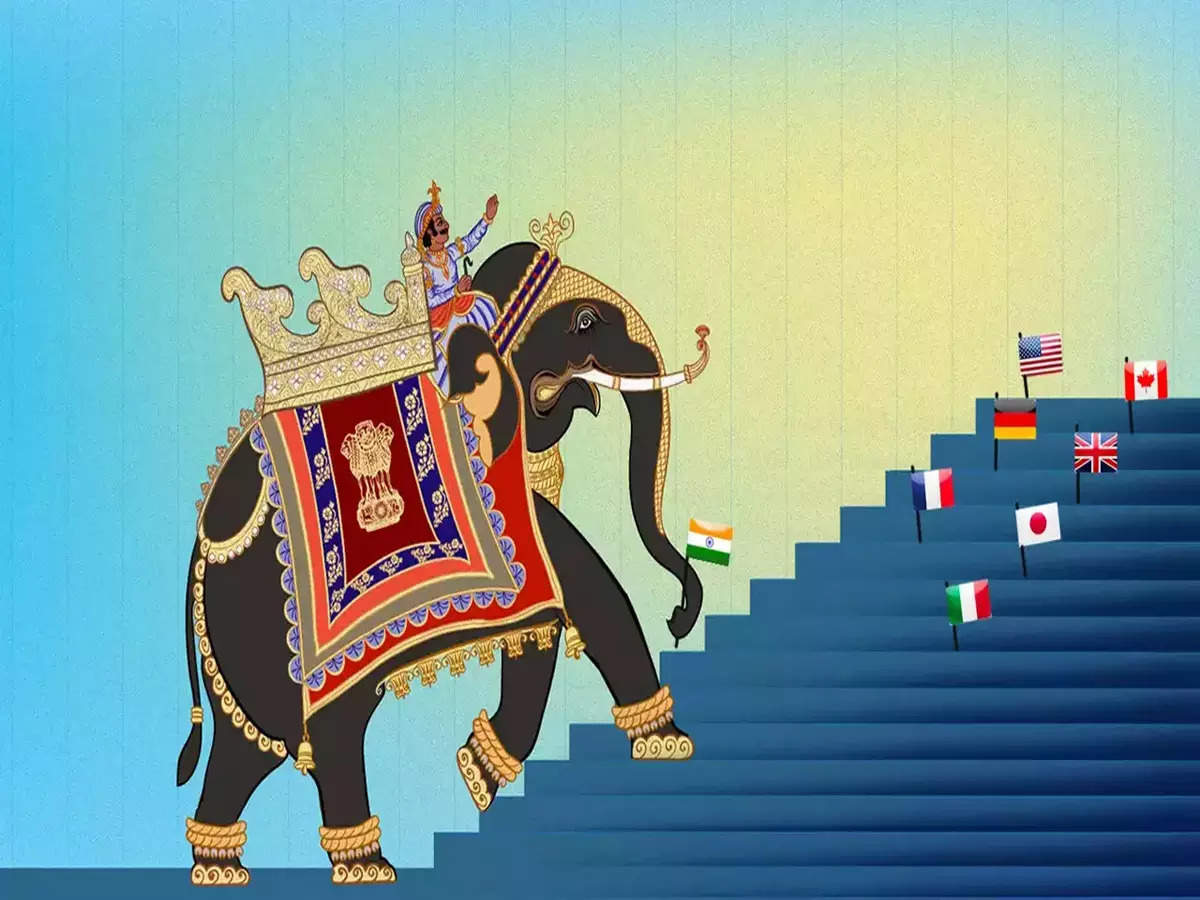

India’s Financial Trajectory

India’s economic system has showcased resilience amid world uncertainties. With robust manufacturing impetus, city spending outpacing rural demand, and bolstered investments, the nation displays a promising development trajectory, DBS mentioned.

Favorable high-frequency indicators within the last quarter of 2023 point out a constructive outlook for India’s GDP development, prompting DBS to boost development intention for FY24 to six.8% from 6.4%.

Forward of the overall elections in April-Could 2024, consumption is predicted to surge through the campaigning interval. Regardless of elections, investments are prone to undertake a wait-and-watch method. Submit-election, an interim FY25 Funds is anticipated to prioritise capital expenditures.

India’s drive to diversify manufacturing past China has attracted world corporations, enhancing its presence within the telecom/handphone meeting sector, DBS famous, including that fiscal incentives coupled with a reinvigorated non-public sector and sturdy infrastructure investments create a conducive setting for development.

Whereas inflation would possibly persist above the goal in FY24 and FY25, the Reserve Financial institution of India (RBI) is anticipated to keep up a cautious stance. The potential for charge cuts could come up within the latter half of FY25, pushed by robust overseas reserves and manageable exterior balances.

DBS mentioned it expects FY25 development to common 6%.

India’s journey amid world financial uncertainties signifies a promising trajectory, supported by a sturdy manufacturing push, strategic investments and a resilient financial outlook.