[ad_1]

The world’s greatest shipper, Indonesia, will halt some cooking oil exports from April 28 after a home scarcity led to road protests over excessive meals prices. This can squeeze already tight provides of vegetable oils and add to the influence of Russia’s invasion of Ukraine that’s thrown sunflower oil commerce into chaos.

Whereas particulars have emerged that Indonesia’s ban will exclude some merchandise, it nonetheless dangers stoking meals inflation additional. World meals prices are at an all-time excessive and surging on the quickest tempo ever. The ever-present use of edible oils in the whole lot from sweet to frying and gasoline signifies that it may properly be a thorn within the aspect of world meals inflation for a very long time to come back.

Listed below are the most recent developments and their far-reaching impacts:

World Meals Provide

The transfer by Indonesia, which accounts for a 3rd of world edible oil exports, will add to turmoil dealing with rising markets from Sri Lanka to Egypt and Tunisia. Even developed nations may see sharp rises in grocery store costs.

Palm oil is likely one of the most versatile staples, utilized in 1000’s of merchandise from meals to non-public care objects to biofuels. Costs of cooking oils have been on a tear because of drought and labor shortages. Then the battle in Ukraine roiled commerce of about 80% of world sunflower oil exports, boosting demand for options like palm and soybean oil and sending costs to report highs.

Indonesia’s ban applies to exports of RBD palm olein, a better worth product that has been processed. Exports of crude palm oil will nonetheless be allowed, the agriculture ministry mentioned in a round. RBD olein accounts for 30% to 40% of Indonesia’s whole palm oil exports.

The transfer may improve prices for packaged meals producers together with Nestle, Mondelez Worldwide and Unilever. Unilever, the maker of Ben & Jerry’s ice cream, Hellmann’s mayonnaise and Dove cleaning soap, mentioned it’s properly positioned to search for various supplies and presently has sufficient provides. Nestle declined to remark, whereas Mondelez couldn’t instantly remark. The ban might power governments to decide on between utilizing cooking oils for meals or biofuels.

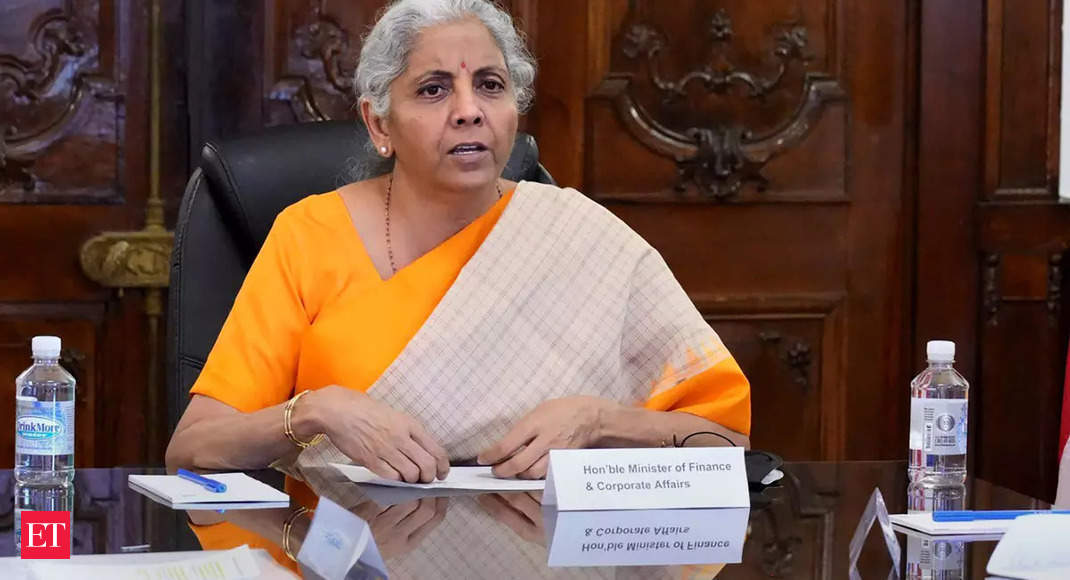

India

India, the world’s greatest importer of palm, soybean and sunflower oils, faces an additional spike in inflation. Home costs of the edible oils in New Delhi surged between 12% and 17% for the reason that battle in Ukraine erupted late February. The federal government has abolished import levies and is attempting to clamp down on hoarding of cooking oil, however costs are exhibiting little indicators of cooling.

Indonesia’s transfer will hit prices and margins of a number of client corporations, monetary providers agency Prabhudas Lilladher mentioned. Hindustan Unilever, Nestle India and ITC Ltd. can be amongst these instantly affected, and the influence can be felt most keenly in biscuits, noodles, muffins, potato chips and frozen desserts.

“If this ban is severely applied, it may be extremely inflationary,” mentioned Atul Chaturvedi, president of the Solvent Extractors’ Affiliation of India. Demand will in all probability shift, however the availability of different edible oils can be restricted.

Indians want palm over different oils as a result of it’s cheaper and could be blended simply with different fat. It additionally lasts longer than different options, making it cost-efficient for bulk customers equivalent to eating places and inns. Cooking oils play a starring position in feasts served throughout the nation’s huge festivals.

China

China is one other large importer of Indonesian cooking oil. It purchased 4.7 million tons of palm oil from the Southeast Asian nation final yr, accounting for greater than 70% of whole imports. China’s purchases have slumped this yr on increased costs and as strict Covid lockdowns harm demand.

In contrast with palm, China is extra depending on imported soybean, which produces each oil for cooking and meal for animal feed to assist the diets of its 1.4 billion inhabitants.

The export ban by Indonesia provides to headwinds for the Chinese language authorities seeking to hold inflation beneath management. Whereas client inflation has remained comparatively subdued, dangers are rising due to hovering commodities costs and Covid-related disruptions to produce chains.

Malaysia

The export ban is a double-edged sword for Malaysia, the world’s second-biggest palm oil producer after Indonesia. Malaysian plantation gamers stand to achieve from a surge in gross sales and windfall earnings from the spike in costs. The nation’s export revenues will probably climb.

Corporations together with Boustead Plantations Bhd., Kuala Lumpur Kepong Bhd., IOI Company Bhd. and Sime Darby Plantation Bhd. climbed on Monday, whereas their Indonesian friends sank. Palm oil futures jumped as a lot as 7% in early commerce, after which retreated as particulars of the excluded merchandise emerged.

Malaysian output poised to get well as staff return

The upper prices of oilseeds could have a rippling impact throughout the Malaysian financial system with its meals inflation already at five-year highs. The federal government should fork out extra subsidies to soak up increased prices of palm oil merchandise. The ban would additionally curtail Malaysia’s palm oil imports, that are largely from neighboring Indonesia, and tighten native provides particularly for refiners.

Malaysia can also battle to fill the hole in international demand left by Indonesia as farmers grapple with continual labor shortages that will solely start to ease from subsequent month. Malaysia makes up a couple of third of the world’s palm oil provide, in comparison with Indonesia’s lion share of about 60%.

Indonesia

Within the close to time period, the coverage will probably obtain its meant impact of driving down home costs of cooking oil on condition that about 60% of Indonesia’s palm oil output tends to be exported, in accordance with Citigroup Inc.

It may additionally ease inflation expectations, Citigroup mentioned, earlier than indications that the ban wouldn’t be as strict as feared. If cooking oil costs revert to early 2021 ranges and stabilize from there, it may cut back the financial institution’s inflation forecast this yr by as much as 0.5 share factors.

This acquire may, nevertheless, be offset by “adversarial second-round impacts” like surging costs of soybean, a substitute of palm. Indonesia imports the oilseed for issues like tofu and tempeh. Soybean merchandise have an identical weight as palm oil within the client value basket, the financial institution notes.